Market Picture

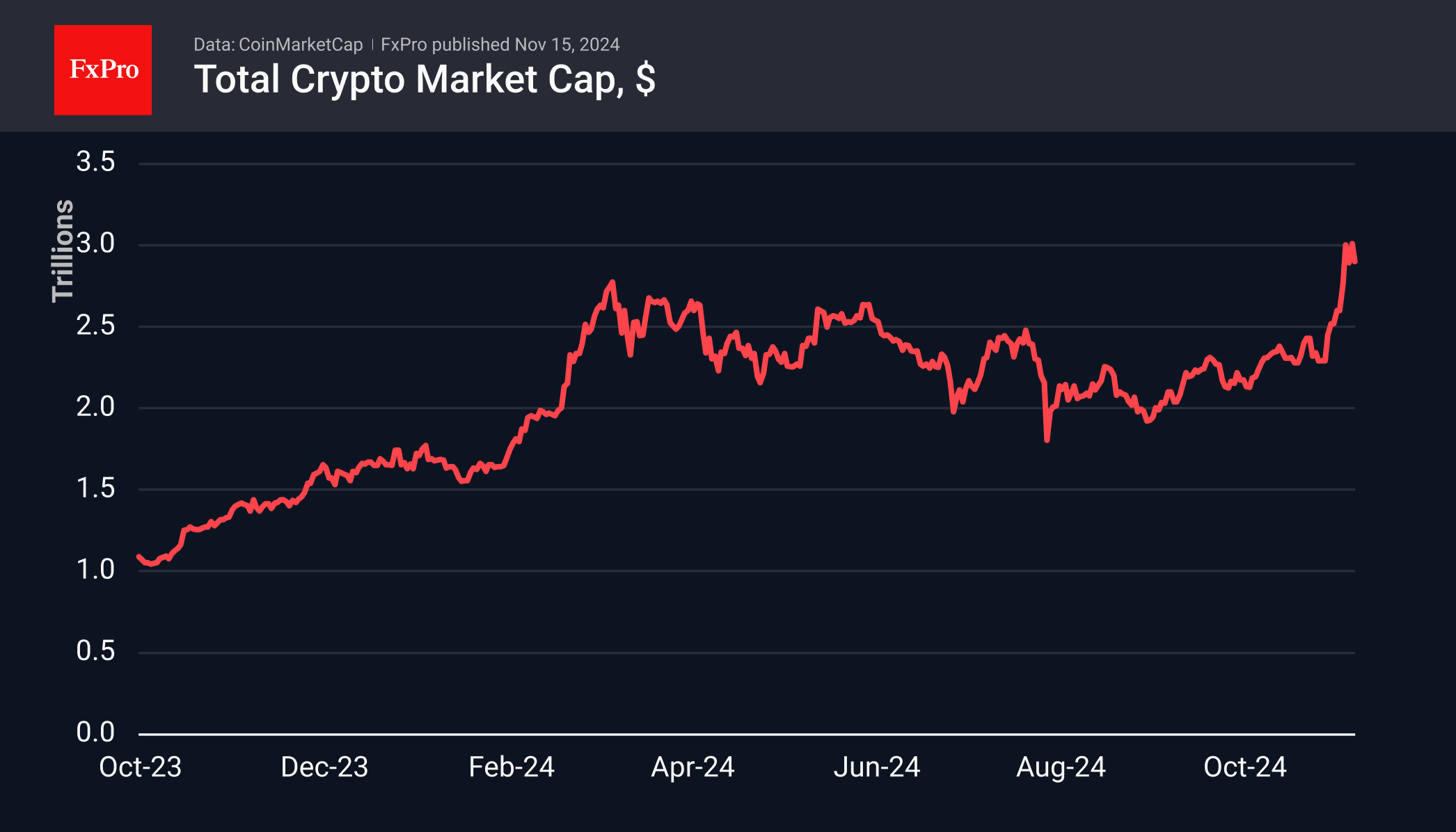

The cryptocurrency market continues to cool for the third day in a row, falling 1.7% in the last 24 hours to $2.92 trillion. This is a retest of the lower end of a range that is seeing serious position shake-offs. This dynamic is also in line with the general risk-off sentiment that has prevailed in the markets this week. By the end of the week, we cannot rule out a deeper correction to the overall level of $2.73 trillion, which is the 61.8% level of the last growth impulse and the consolidation area of 10-11 November.

Bitcoin is consolidating below $88K, opening and closing within the $88K–$89K range for the fourth day. On the daily timeframe, the RSI is about to fall below the 80 level, which could trigger a deeper shakeout with a pullback to $83K.

Ethereum has pulled back to $3,000, losing 12% from its peak in a four-day correction. Local support could come from the 200-day average at $2,950, which coincides with the coin’s support area from April to July this year.

News Background

The PEPE meme token has soared over the past two days, reaching a record capitalisation of over $9.6 billion and the 15th spot in the CoinMarketCap ranking. The coin surged after listing on several crypto platforms, including Robinhood and Coinbase.

K33 Research notes that bitcoin’s correlation with gold fell to an 11-month low (-0.36). The divergence occurred after Trump won the presidential election. Since then, bitcoin has rallied 20% to a new ATH, while the precious metal has fallen 5% on the back of a stronger dollar and rising US Treasury yields.

According to a survey by digital bank Sygnum, 57% of institutional investors intend to increase their investments in cryptocurrencies. 65% of respondents are optimistic about the crypto market. According to 69% of respondents, high price volatility is the main barrier to entry into the crypto market.

Mike Novogratz, CEO of Galaxy Digital, said Bitcoin will reach $500,000 if the US creates a strategic reserve in the first cryptocurrency. US President-elect Donald Trump made a similar proposal during his election campaign.

According to HashKey Group, the Trump administration’s friendly attitude towards cryptocurrencies will be one factor forcing China to lift restrictions on the cryptocurrency market.

Ethereum developers have unveiled the concept of ‘smart transactions’, bringing the realisation of the ‘world computer’ closer. Due to a more dynamic set of features, Smart Transactions (STXN) will significantly expand the range of applications and protocols.

The FxPro Analyst Team