Market Overview

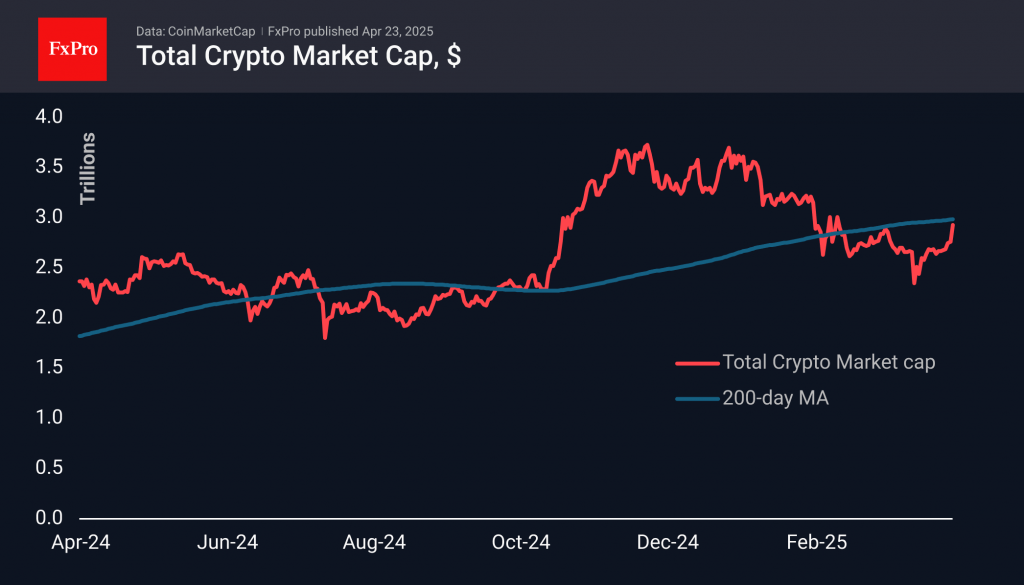

The cryptocurrency market capitalisation surged by 6.4% in the past 24 hours, reaching $2.95 trillion — its highest level in seven weeks and a confident return to a key round figure. Global financial markets underpinned this rally. However, it’s worth noting that the market was already gaining ground on Monday, in defiance of declining stock indices.

Sentiment in the cryptocurrency space has swiftly shifted towards greed and is now steps away from extreme greed, with the relevant index climbing to 72, the highest since late January.

Bitcoin is nearing the $94,000 mark, which it briefly surpassed in early March. Sustained trading above this level was last observed in late February, before the most recent sell-off began. The market has signalled a clear bullish trend, initiating a sharp rise from the 50-day moving average and breaking through the 200-day with determination. In recent days, the price has also exceeded the downward resistance that had been in place since late January. The next target seems to be the $96,000 region, but the broader picture suggests a rally gaining momentum with the potential to challenge all-time highs near $110,000.

News Background

Last week, MicroStrategy acquired an additional 6,556 BTC for $555.8 million at an average price of $84,785 per coin. The company now holds 538,200 BTC, accumulated at an average cost of $67,766. The total investment is estimated at $36.47 billion.

Shares of consumer goods producer Upexi skyrocketed more than sixfold after the company announced that Solana would be adopted as a reserve asset. The company plans to bolster its position in SOL and stake the tokens it possesses.

According to Lookonchain, Mike Novogratz’s Galaxy Digital has exchanged $105 million worth of Ethereum for Solana over the past fortnight.

Paul Atkins has officially been sworn in as the new Chair of the US SEC. He has stated that developing a clear and comprehensible regulatory framework for digital assets is a top priority.

According to Politico, the ECB is concerned that President Trump’s backing of the crypto industry could trigger “financial contagion” and adversely impact the European economy. The regulator is particularly apprehensive about the escalating influence of US dollar-backed stablecoins.

The FxPro Analyst Team