Market picture

The crypto market is now showing increased volatility. On Monday morning, the price climbed from Friday’s low of $19.5K up to $22.7K. There are more fundamental factors behind bitcoin’s decline, while we see tech behind the rebound in recent days.

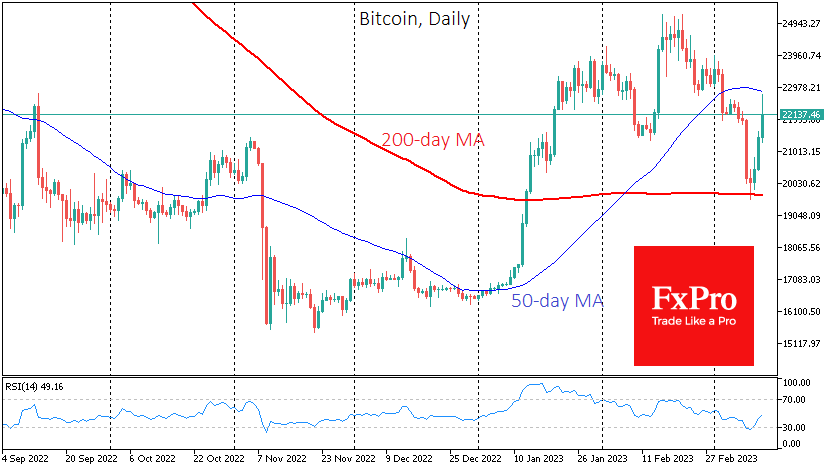

The problems at Silicon Valley Bank triggered a sell-off in risky assets, including bitcoin. At one point, it fell below its 200-day average, although it was higher at Friday’s close, attracting buyers. Later, the RSI on the daily timeframe moved out of the oversold territory – another early bullish signal.

However, the upside amplitude was provided by reduced liquidity. On Monday, Bitcoin faces an important test of market sentiment. During the day, we must watch closely to see if we have a clean sell-off by the hawks. If so, it’s an important signal that the recent rally was false and that the big players are still selling at better prices.

Potential buyers would still be better off waiting for a fix above $23K to confirm a bullish reversal.

According to CoinMarketCap, the total capitalisation of the crypto market passed $1 trillion on Monday morning.

Stablecoin USD Coin (USDC) lost its peg to the US dollar on Saturday, falling below $0.88 amid the collapse of Silicon Valley Bank (SVB), which held $3.3 billion of its reserves. DAI is also in trouble, falling below $0.90 as USDC partially backs the token. At the same time, many other stablecoins have crossed the $1.01 mark.

News background

Tron founder Justin Sun proposed the creation of a bank for the needs of the crypto industry amid the collapse of Silicon Valley Bank.

Michael Barr, deputy head of the US Federal Reserve, has proposed creating a group to develop the regulation of crypto assets. According to him, if the Fed fails to regulate stablecoins, their widespread adoption could threaten the US economy.

The US Treasury unveiled plans for the 2024 budget replenishment and said it intends to impose a 30% excise tax on mining companies’ electricity use.

Renowned economist and cryptocurrency sceptic Peter Schiff called for cryptocurrencies to be sold as the industry is “about to see more bankruptcies”. He pointed to the collapse of Silvergate Bank and US economic data that would force the Fed to raise interest rates.

Twitter CEO Elon Musk said he was “open to the idea” of buying the troubled Silicon Valley Bank to turn the social network into a financial hub and digital bank.

The FxPro Analyst Team