Market Picture

The cryptocurrency market increased modestly by 0.35% in 24 hours to $2.53 trillion. Bitcoin rose by 0.7% in that time, Ethereum changed a little, and many altcoins came under slight pressure.

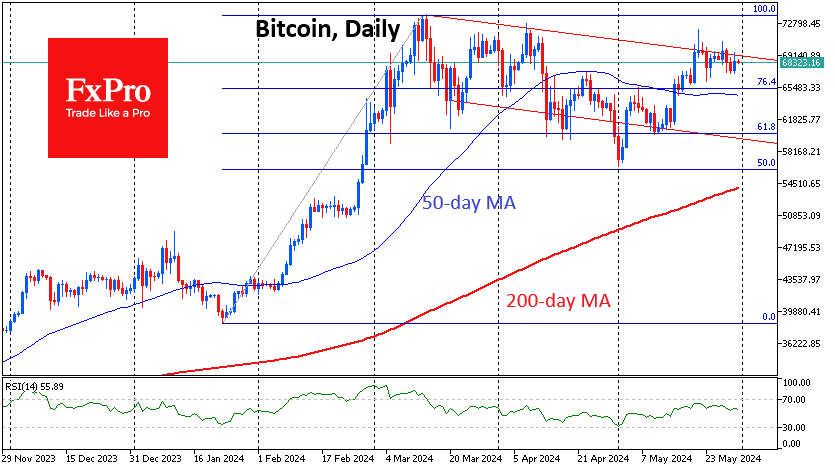

Bitcoin continues to hang out under the resistance of the descending corridor, where a temporary balance seems to have been found, having been here for 11 days.

Altcoins have a little more gloom. XRP, Cardano, and Litecoin are moving downwards, sticking to their 50-day moving averages for more than a week now. The market is clearly taking its time getting rid of former stars. It’s a logical process, but as applied to cryptocurrencies, it also says that we’re not yet in FOMO mode when all the names are added up.

News background

Fidelity’s spot, Ethereum-ETF, has appeared on the US National Settlement Depository’s (DTCC) asset list. DTCC has so far listed similar products from VanEck, Franklin Templeton, and BlackRock.

Ethereum-ETF issuers now need S-1 document approval from the SEC to begin trading. BlackRock has filed an updated Form S-1, which disclosed information about the start-up investor. Bloomberg Erik called BlackRock’s filing a “good sign.”

Elon Musk denied Bloomberg’s publication that he is Trump’s cryptocurrency adviser. According to him, “he certainly never discussed cryptocurrencies with Trump.”

Inflows into the Ethereum-ETF will be significantly lower than those of similar Bitcoin-based funds, JPMorgan expects.

The New York Stock Exchange (NYSE) has allowed the launch of cryptocurrency trading under a regulatory framework.

Gemini Earn customers will be refunded 100% of their $2.18bn assets more than a year after the programme was closed due to the Genesis bankruptcy. The funds will be distributed in kind, that is – in the form of those cryptocurrencies that were initially blocked on the platform.

Telegram’s official cryptocurrency wallet, Wallet, announced a change to its custodial service provider and strengthened the collection of user data. Updated security rules now require additional personal information.

The FxPro Analyst Team