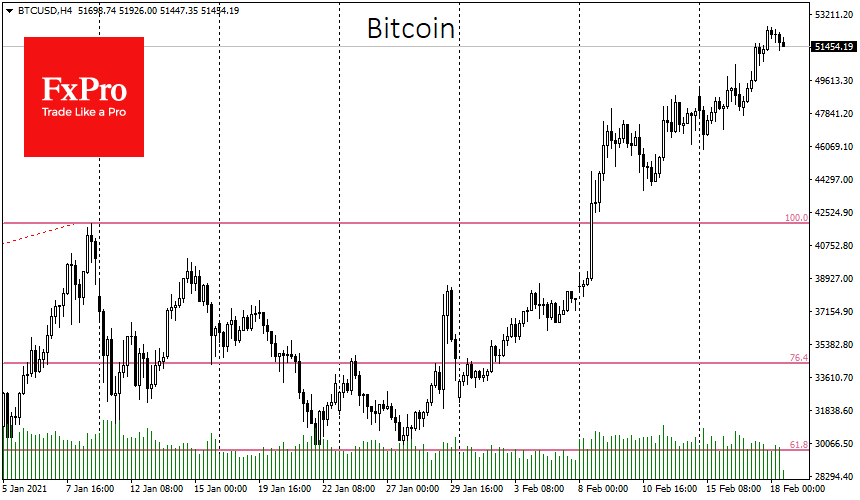

The crypto market is slowly recalling a long-forgotten sense of hype and FOMO. As Bitcoin rises, there are fewer sellers in the market. The market has forced the most cautious investors to close positions in the $20-$30K range. Around $50K, the optimists were selling. After a confident overcoming of the most important technical and psychological level, most market players paused because, on the one hand, the price stopped near $52K. On the other hand, everyone can see that the bears never entered the main stage, and the sellers are not trying to push Bitcoin below the round level.

Another boost to Bitcoin was MicroStrategy’s decision to raise $900 million to buy Bitcoin. Buyers remain hopeful that Bitcoin purchases on Tesla’s balance sheet are just the beginning in a long line of similar announcements from other companies. The supply/demand balance also remains in Bitcoin’s favour as 150K BTC were mined in the last 5 months of 2020, and almost 360K were redeemed. The infrastructure for institutional investing continues to evolve, and regulators have approved Bitcoin-ETFs in Australia and Canada. Another positive for BTC can be seen in St. Louis Fed Chairman James Bullard’s statement that Bitcoin is a rival for gold, not the dollar.

We have now arrived at the point where even the pessimists have put their selling decisions on pause. Perhaps the market has moved to the point where most are aiming in one direction: up. But this situation is dangerous because mass FOMO and greed bring to the market a shadow layer of big investors, who, taking advantage of the infrastructure for investing that has been created over the years, can start playing against the market. Thus, it is not necessarily the case that growth will stop anytime soon, but it is worth being particularly cautious now, at a time when there is a lot of excitement about the prospects of the crypto market.

Mainstream media, publishers, and groups are already full of memes about Bitcoin. This points to the crowd’s deep regrets about the missed opportunity to buy Bitcoin in the recent past. If the coin continues to grow steadily toward $60K, this could be a trigger for many non-professional investors to invest at these incredibly overheated price levels.

In fact, such investing may have direct references to buying Bitcoin around $20K in late 2017, when it seemed like the asset could only go up. No one knows the exact moment of the trend reversal, but it is clear that by buying Bitcoin above $50K, an investor is taking huge risks, and it is possible that after the slump, it will take years to return to current levels.

The FxPro Analyst Team