Bitcoin fell 1.8% on Tuesday, ending the day around $37,700 and temporarily below a meaningful support line. Notably, it was a cryptocurrency selloff as stock indices developed gains. The demand for risk recovery has likely returned interest in cryptos that went into the green on Wednesday.

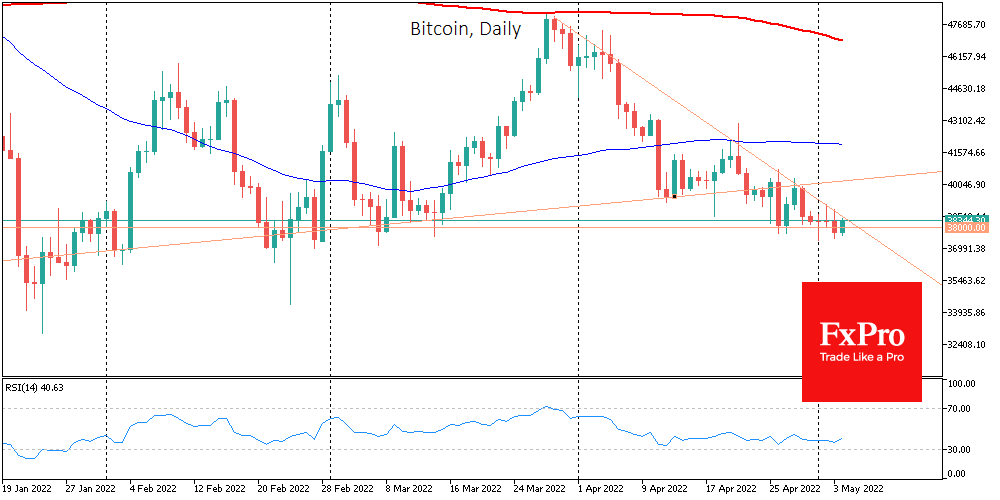

Locally, bitcoin manages to maintain its balance on support, which has withstood the onslaught of sellers over the past four months. On the other hand, we see a sequence of increasingly lower local peaks since the last days of March.

The lines of these two trends have reached their intersection point with a potential climax later today. Often, the outcome of such triangles is to break the support because if it goes under $38K, we might see a rising wave of selloffs. A return to the uptrend will require confirmation with a decisive move above $40K, the area of previous local lows.

Today, the market driver will be the FOMC, whose decisions and comments could reverse or reinforce the multi-week trend of the dollar leaving and curtailing demand for risky assets.

The cryptocurrency market is approaching the big event in a state of extreme fear, with the relevant index dropping 6 points to 21 by Wednesday.

The total capitalisation of the crypto market, according to CoinMarketCap, fell 1.3% overnight to $1.72 trillion.

According to Morgan Stanley, bitcoin’s dependence on the stock market undermines the cryptocurrency’s potential as an inflation risk hedge. Meanwhile, the correlation between bitcoin and a protective asset such as gold has fallen to its lowest level since 2018.

Brian Armstrong, Coinbase CEO, believes that despite the volatile state of the crypto market since early 2022, the number of cryptocurrency users will increase 5-fold over the next 10-20 years and reach more than 1 billion people.

The US Securities and Exchange Commission (SEC) creates a new unit to oversee the crypto market and expand its staff to combat digital fraud.

Argentina’s largest banks, Banco Galicia and Brubank, have announced that their customers will soon be able to trade in cryptocurrencies.

The FxPro Analyst Team