Market Overview

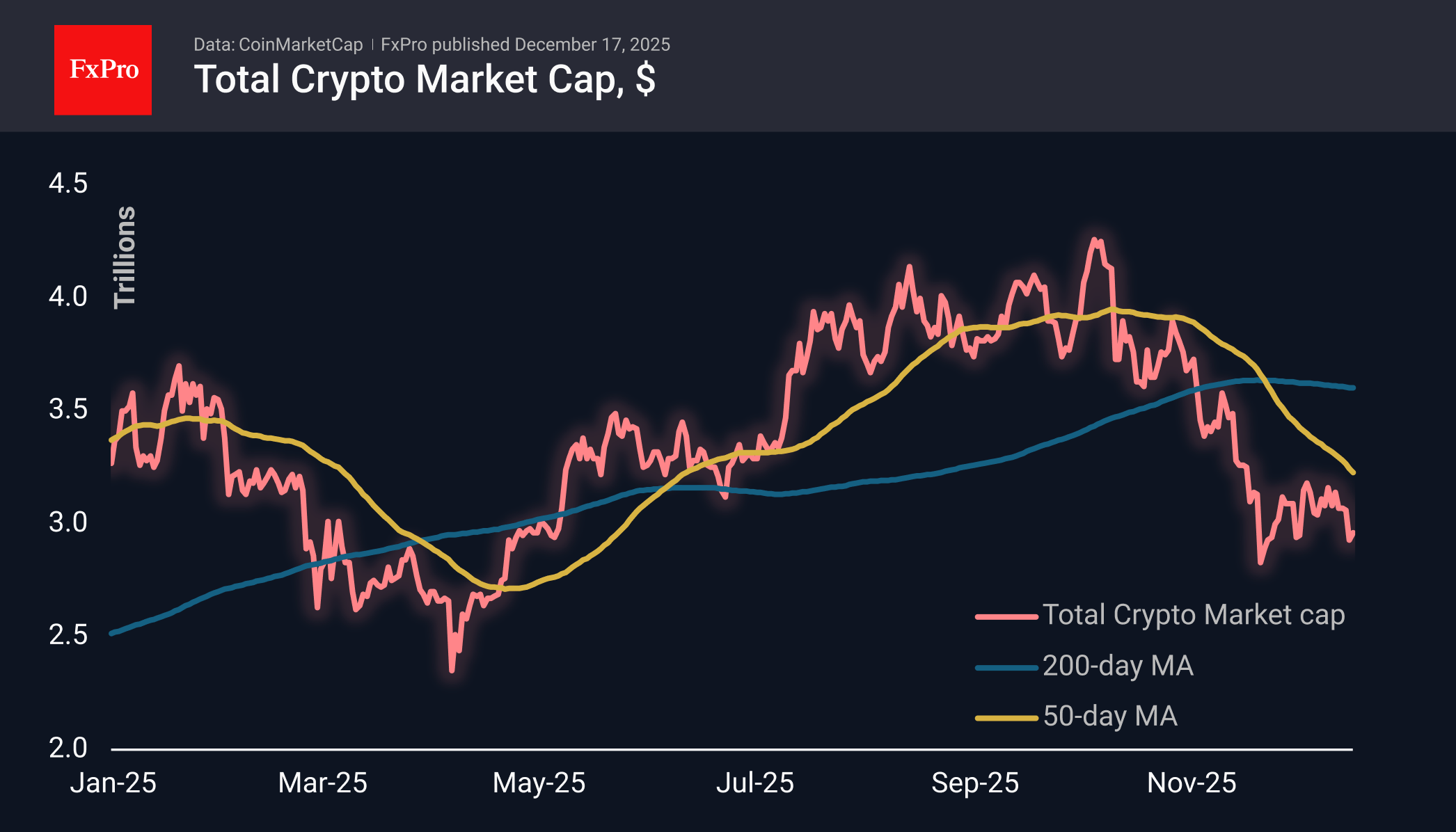

The crypto market capitalisation has changed little over the past 24 hours to $2.96T, remaining close to its late November lows. In the short term, the situation suggests that the rebound has run its course, and we should prepare for a new downward momentum, similar to what was observed in early October. If it falls below $2.75T, it will open a direct path to the $1.8T area, according to the Fibonacci extension pattern. Very close by, in the $1.8T–$1.9T area, is the area of local lows for 2024, which reinforces its importance.

Bitcoin rose to $88K on Tuesday and then returned below $87K on Wednesday afternoon. As with the market as a whole, we are seeing impressive selling pressure with short pauses for a rebound. Bitcoin is still underperforming the stock market. However, this time we see it more as a sign of internal weakness in the crypto market and widespread profit-taking, rather than a bad omen for stocks, but it cannot be completely ruled out.

News Background

Short-term Bitcoin holders are incurring losses, as the asset has been trading below their average entry price ($104,000) for over a month, according to CryptoQuant. At the same time, long-term holders of the first cryptocurrency continue to actively sell it. According to Glassnode, they have reduced their holdings by ~500,000 BTC since July.

Bitcoin could crash to $10,000 in 2026, warned Bloomberg Intelligence commodities strategist Mike McGlone. He suggested that the next economic recession will be triggered by the collapse of highly speculative digital assets with unlimited supply.

Analyst Peter Brandt predicted that Bitcoin could fall 80% from its record high to $25,240 due to a disruption in the asset’s growth structure.

At the same time, Bitwise and Grayscale predict that Bitcoin will reach new record highs in 2026, as the classic BTC cycle model is outdated.

Japanese financial conglomerate SBI Holdings and Web3 company Startale Group have signed a memorandum of understanding to jointly develop a stablecoin pegged to the yen. The partners plan to launch the asset in the first quarter of 2026.

The number of Britons owning cryptocurrency has fallen from 12% to 8% over the year. However, the average value of assets held by investors has increased.

The FxPro Analyst Team