Market Picture

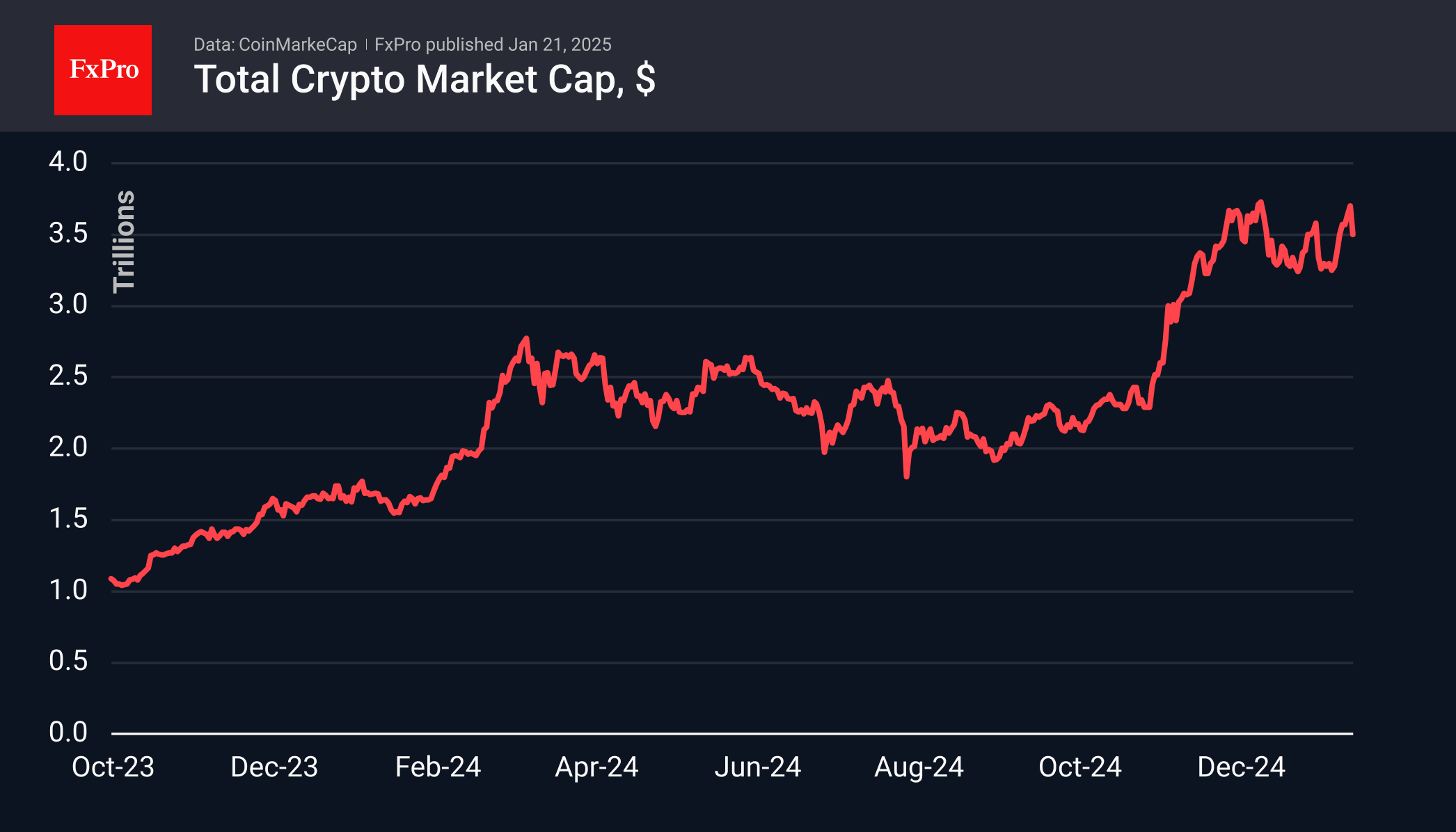

The cryptocurrency market experienced a decline, with a reduction of approximately 5.3% compared to the previous day. This downturn was attributed to high expectations surrounding Trump’s inauguration speech, which did not mention cryptocurrencies. Consequently, the total capitalisation of cryptocurrencies decreased to $3.5 trillion, reverting to the level observed at the end of the previous week. While this indicates a reduction in optimism, it does not suggest a market reversal.

The Cryptocurrency Fear and Greed Index stands at 76, having ranged between 75 and 77 for six consecutive days. This is considered the initial stage of ‘extreme greed’. Observations indicate that during a bull market phase, values exceeding 80 increase the risk of a corrective pullback, whereas current values may coexist with further movement towards historical highs.

Bitcoin reached a new all-time high on Monday, approaching the $110k level. However, significant selling followed, resulting in a 9% pullback from the peak. By the start of trading in Europe, Bitcoin was trading near $102k. The resistance level observed on January 7th temporarily became support. It is anticipated that the market will progress gradually, overcoming one level after another.

Corrective pullbacks also impacted other major altcoins. Over the past 24 hours, Ethereum decreased by 4.3%, XRP fell by 5.8%, and Solana declined by 9.6%.

News Background

According to CoinShares, global investment in crypto funds increased 46 times last week to $2.195 billion, the highest in five weeks. Investments in Bitcoin rose by $1.903 billion, Ethereum by $246 million, XRP by $31 million, and Solana by $2.5 million.

The SEC reported a surge in applications to launch cryptocurrency ETFs in the US, with more than a dozen applications submitted by major management companies in recent days.

Following the change of administration in the US, MN Consultancy founder Michael van de Poppe highlighted significant growth potential in three categories of crypto assets: cryptocurrencies previously classified as securities by the SEC, including XRP, Matic, and Algorand; coins from World Liberty Financial’s portfolio, such as Chainlink and Aave; and Ethereum ecosystem projects.

On Polymarket, a prediction platform, voting on creating the Bitcoin reserve within the first 100 days of Trump’s presidency indicated a shift in sentiment. The odds of a favourable outcome decreased from 48% to 29% in less than 24 hours.

The FxPro Analyst Team