Market picture

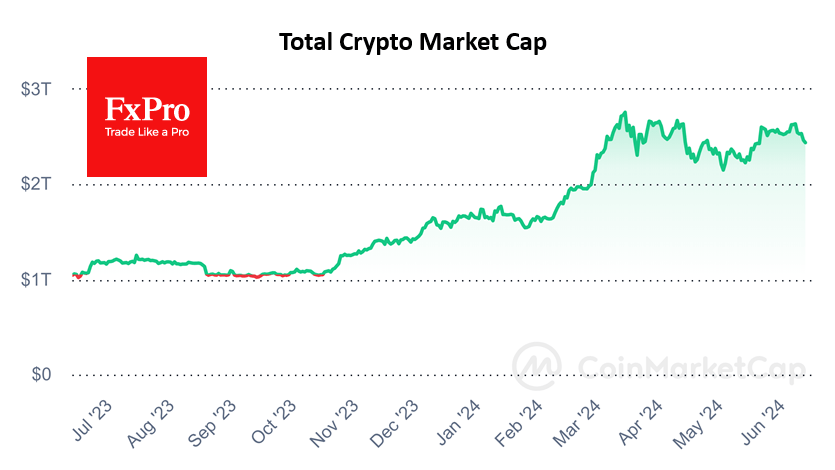

The crypto market cap lost another 0.9% over the last 24 hours, pulling back to $2.44 trillion and extending losses from Friday’s peak to 8%. Since the end of the day on Tuesday, market volatility has noticeably decreased as more traders are taking a wait-and-see stance ahead of the inflation report and FOMC meeting results.

Technically, Bitcoin’s 50-day moving average acted as support, which stopped the active sell-off. If the decline develops, the next support is seen only in the area of $60K. If risk appetite returns to the markets, the price may not only quickly exceed $70K but also head for the renewal of all-time highs.

Bitcoin’s average annualised rate of return over its time on the market has exceeded 103%, Curvo calculates. That’s higher than the annual growth rate of the portfolio of America’s most famous investor, Warren Buffett (10%).

News background

The record, 19-day series of inflows into spot bitcoin-ETFs has come to an end. On 10 June, BTC-ETFs saw a net outflow of $64.9 million. Cumulatively, about $4 billion has flowed into spot bitcoin-ETFs during the longest wave and $15.62 billion since the instruments were approved in January.

“Dormant” for more than five years, 8,000 BTC were moved to Binance, Lookonchain pointed out. The coins were purchased at the bottom of a bear market in December 2018 for $3800.

Billionaire Mark Cuban has said that attitudes towards cryptocurrencies will be a key difference between US presidential candidates Donald Trump and Joe Biden, although both are not versed in the issue.

Japanese public company Metaplanet said it bought 23,351 BTC ($1.58 million), bringing its total balance in the first cryptocurrency to 141.07 BTC ($9.54 million). The average purchase price of 1 BTC was ~$65,300. In April, Metaplanet announced the transfer of funds in its treasury to BTC, explaining the decision with the continued weakening of the yen.

Ernst & Young Hong Kong said institutional investors in Hong Kong may significantly increase their investments in crypto-assets in the next two to three years. Investments in digital assets by institutional investors and family funds in Hong Kong could reach $500bn.

According to a survey conducted by crypto exchange Easy Crypto, about 14% of New Zealanders surveyed own or previously owned cryptocurrencies. In 2022, the figure was 10%.

USDT issuer Tether is investing more than $1bn over the next 12 months in AI, new payment solutions and biotechnology.

The FxPro Analyst Team