Market Overview

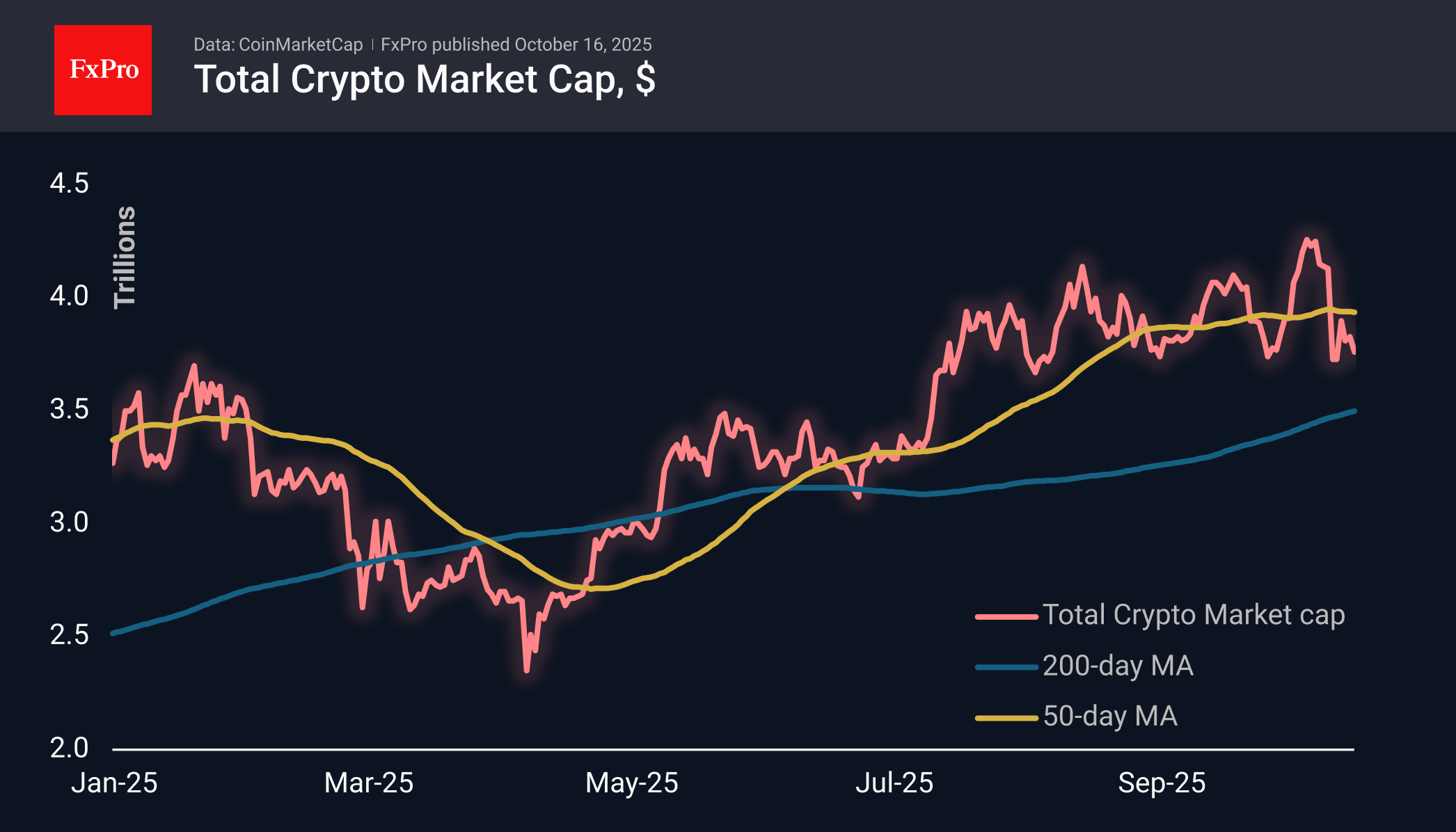

The crypto market capitalisation lost 2.3% from the previous day’s level to $3.75 trillion. The rebound on Sunday and Monday did not develop, and the 50-day moving average acted as local resistance. The market is again testing the strength of 3-month support near current levels. Such persistence from the bears suggests that the next stage will be a test of the 200-day average, which passes through $3.5 trillion. The market broke above this line in May; touching it at the end of July triggered strong buying.

Bitcoin is trading above $110K, as is the entire market, approaching the support level of the last three months. Several facts reinforce the importance of the current moment: BTC is trading near a crucial milestone, which was also the resistance area in the first half of the year, and the 200-day moving average is approaching this level, currently at $107.4K but heading towards $109K by the end of the month.

News Background

Bitcoin has entered a ‘speculative phase,’ and new major players are taking control of it, according to XWIN Research. This means that long-term investors are taking profits, and less experienced market participants are taking their place.

An opportunity to buy has emerged in the crypto market, said former BitMEX CEO Arthur Hayes, citing Fed Chair Jerome Powell’s comments that the quantitative tightening programme may soon be completed.

K33 also sees current levels attractive for building spot BTC positions, as ‘leverage has been aggressively reduced.’ The options market points to further growth in BTC to the $115K-$130K range, Glassnode notes.

Trading veteran Peter Brandt presented two scenarios. According to the first, Bitcoin could renew its historic high after the current correction ends. Otherwise, a drop to $50K-60K is possible.

According to Bitwise, forty-eight new companies began accumulating Bitcoin reserves in the third quarter. In three months, the number of Bitcoin treasuries grew to 172 with combined reserves of over 1 million BTC (more than $110 billion).

About 40% of the total volume of Ethereum has been removed from active circulation, which is a record high in history, notes analyst Crypto Gucci. BitMine CEO Tom Lee confirmed his forecast for ETH to grow to $10,000 by the end of this year.

The FxPro Analyst Team