Market Picture

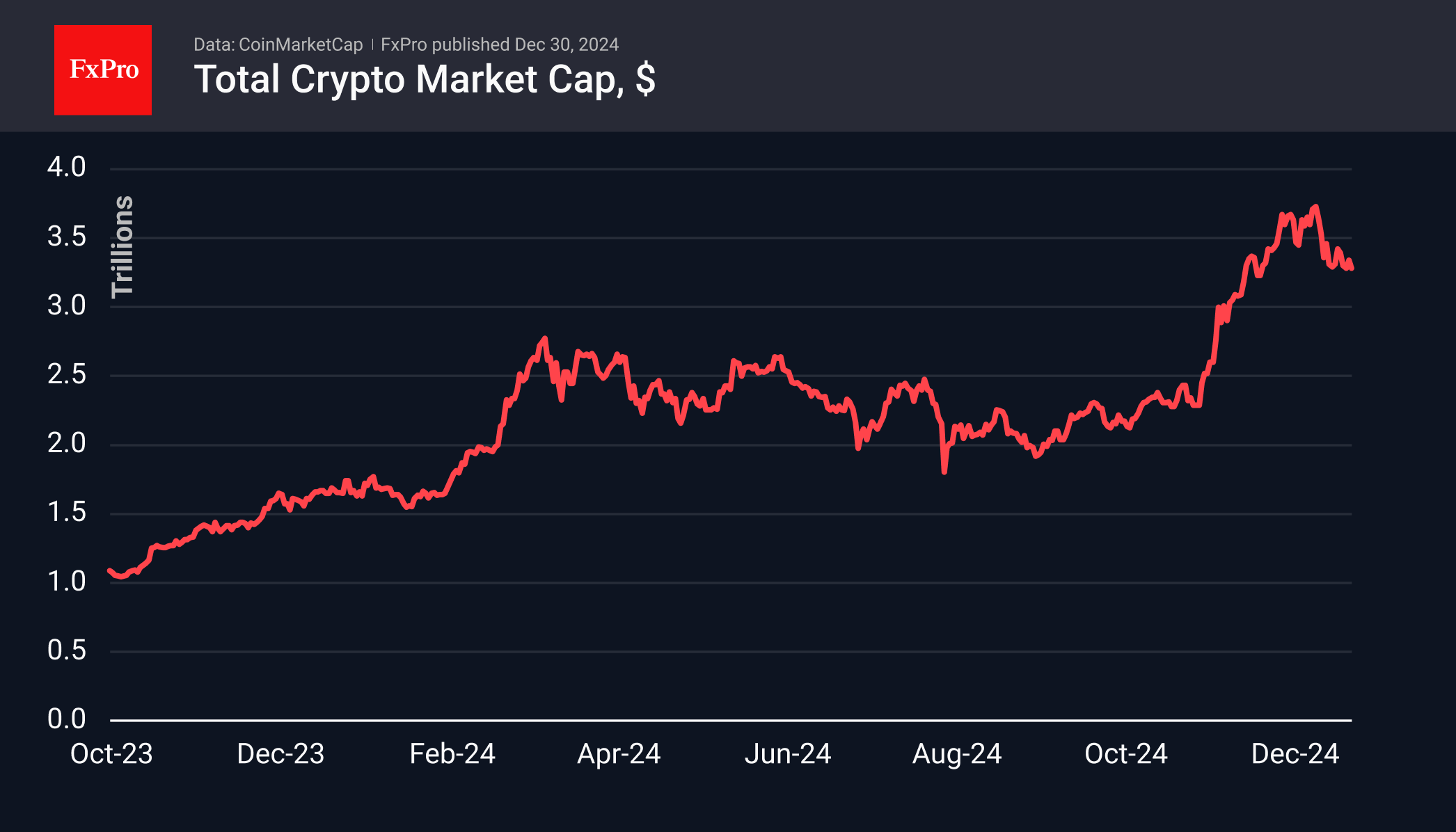

The cryptocurrency market has lost 1.4% in the last 24 hours, falling to $3.29 trillion. Over the past 10 days, the market has mostly stayed in the $3.3-3.4 trillion range, pulling back to late November levels where positions were also shaken out. Here is the classic 61.8% retracement level from the early November rally to the mid-December high.

The price of Bitcoin pulled back to $93.5k, falling below the 50-day moving average after Christmas. Like the rest of the crypto market, bitcoin has returned to the 61.8% level. Bitcoin is on the verge of a technical pullback, and a failure below $93k would signal a break in the short-term trend, which could lead to a deeper decline that could erase all the gains made in November-December.

Among the top coins, Ethereum managed to swim against the tide, adding 0.6% for the day. The coin has been attracting buyers on the decline towards $3300 in recent days, forming an uptrend.

News Background

Net outflows in the BTC ETF for the week totalled $387.5 million, the highest since early September. The positive weekly trend was broken after three weeks of inflows. Cumulative inflows since the launch of bitcoin ETFs in January fell to $35.66 billion (-1.1% for the week).

Net inflows into ETH ETFs rose to $349.2 million for the week. The positive weekly trend continued for the fifth consecutive week. Cumulative net inflows from ETF launches in July rose to $2.68 billion (+15% for the week).

Strive Asset Management has filed to launch a bond ETF for bitcoin strategy companies such as MicroStrategy. The firm was founded by Vivek Ramaswamy, who will be working with Elon Musk at DOGE under the Trump administration.

CryptoQuant CEO Ki Young Ju said that the bearish trend in the bitcoin market has not yet formed, and the price is far from its peak. In his opinion, BTC will soon rise by more than 30%.

Bitcoin selling pressure and increased volatility may intensify in the coming days, believes a CryptoQuant contributor nicknamed IT Tech. He noted an increase in bitcoin reserves of centralised exchanges – by about 20,000 BTC in recent days.

The FxPro Analyst Team