Market Picture

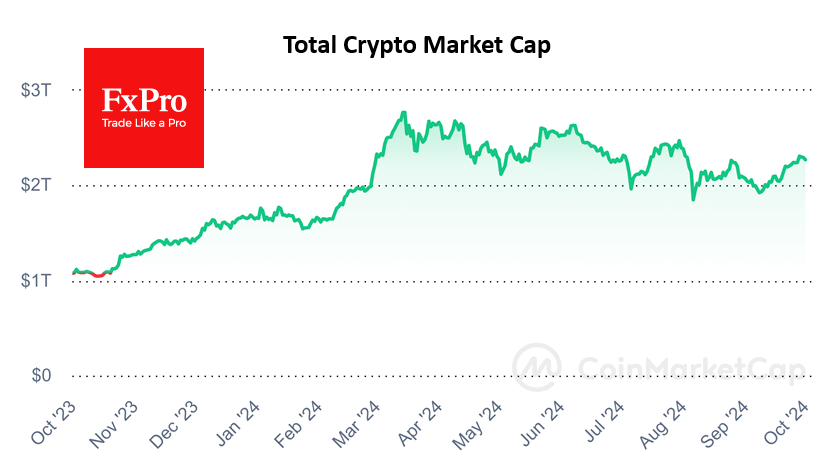

The cryptocurrency market starts the week on the defensive, losing 1.2% of its capitalisation in 24 hours to $2.27 trillion, although it is still up 3% from a week ago. This drawdown looks like short-term profit-taking from the recent wave of gains amid the risks of the upcoming jobs report and Powell’s comments.

The first cryptocurrency is down 2.6% on Monday, retreating to $64.0K. On the technical side, bitcoin has come under pressure near the upper border of a multi-month downtrend. However, we see this as having more of an emotional component, as we believe that the break above the previous highs and the 200-day moving average served as an important signal of bullish dominance.

Bitcoin is on the verge of its best September since 2012. BTC has gained more than 11% since the beginning of the month, in stark contrast to the typical decline this month. The altcoin index is up more than 20% after easing financial conditions amid a global wave of interest rate cuts by the Fed, ECB and PBC.

Bitcoin closed higher for the third week, hitting its highest level since late July on Friday at around $66,500. The positive momentum in US spot bitcoin ETFs continued through all five trading sessions of the week.

News Background

According to SoSoValue, inflows into US spot bitcoin ETFs totalled $1.11 billion last week, the largest in 10 weeks, including inflows of $494.3 million. Cumulative inflows since the launch of BTC ETFs in January rose to $18.80 billion (+6.3% for the week). The Ethereum ETF turned positive after six weeks of outflows, with net inflows of $84.5 million.

Prices for 90% of altcoins traded on Binance have crossed above the 50 DMA, notes GoaSymmetric. Altcoins are ‘waking up’. ‘This is nothing compared to what we will see in the next six months,’ said Michael van de Poppe, founder of MN Trading.

Grayscale has updated its list of 20 cryptocurrencies that could outperform the market in Q4. As a result of the next rebalancing, SUI, TAO, OP, HNT, CELO, and UMA will be added to the ‘model portfolio’. RENDER, MNT, RUNE, PENDLE, ILV and RAY were removed.

CCData calculates that the companies behind the top five stable coins by market capitalisation will lose about $625m in annual revenue after the Fed’s 50bp rate cut in September. US Treasuries account for 80.2% of stablecoin issuers’ reserves. Cumulatively, they hold around $125bn of the country’s national debt.

The FxPro Analyst Team