Market Picture

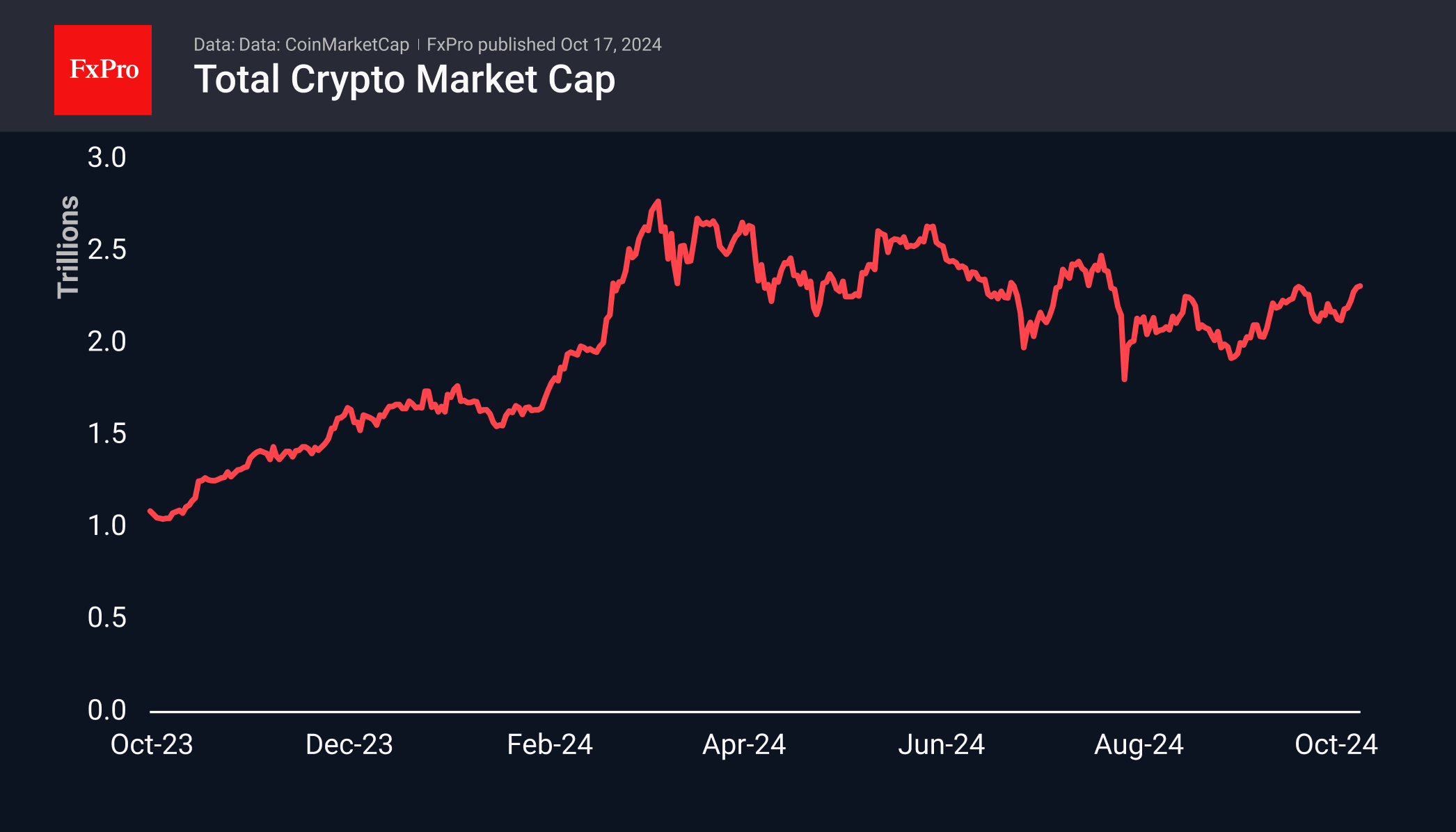

The cryptocurrency market remains steady at around $2.31 trillion in market capitalisation, mirroring the local highs of late September, while Bitcoin continues to climb. The pause in overall growth has led to a 2-point dip in the Cryptocurrency Market Sentiment Index, now at 71—still reflecting a high level of greed.

Bitcoin is currently at $67.1K, showing a 0.5% increase over the past 24 hours but a slight 0.5% decline since the day’s opening. These minor fluctuations largely mirror the stabilisation seen in stock indices. This pause benefits the Bitcoin bulls, allowing the market to cool off after the recent rally.

The upcoming ECB interest rate decisions and US retail sales figures, set to be released just before the US session begins, could potentially disrupt the market’s current stability.

News Background

Tesla has transferred its entire 11,509 BTC holdings, valued at approximately $760 million, to unknown addresses, as reported by Arkham Intelligence. Meanwhile, SpaceX, also owned by Elon Musk, continues to hold 8,285 BTC in Coinbase’s Prime Custody wallet service.

Since Bitcoin reached new highs in March, the gap between demand and ‘active supply’ has widened, a trend that Glassnode notes is historically a precursor to periods of heightened volatility.

According to its issuer, Tether, at the end of the third quarter of 2024, the USDT stablecoin was used by 330 million cryptocurrency wallets and on-chain accounts. The company compared the figure to the US population and attributed the increase in users to second-tier solutions and the development of the TON ecosystem.

The Kenya Revenue Authority is introducing a new control system that will integrate with cryptocurrency exchanges. This system will enable real-time tracking of crypto transactions to ensure timely tax collection.

The FxPro Analyst Team