Market Overview

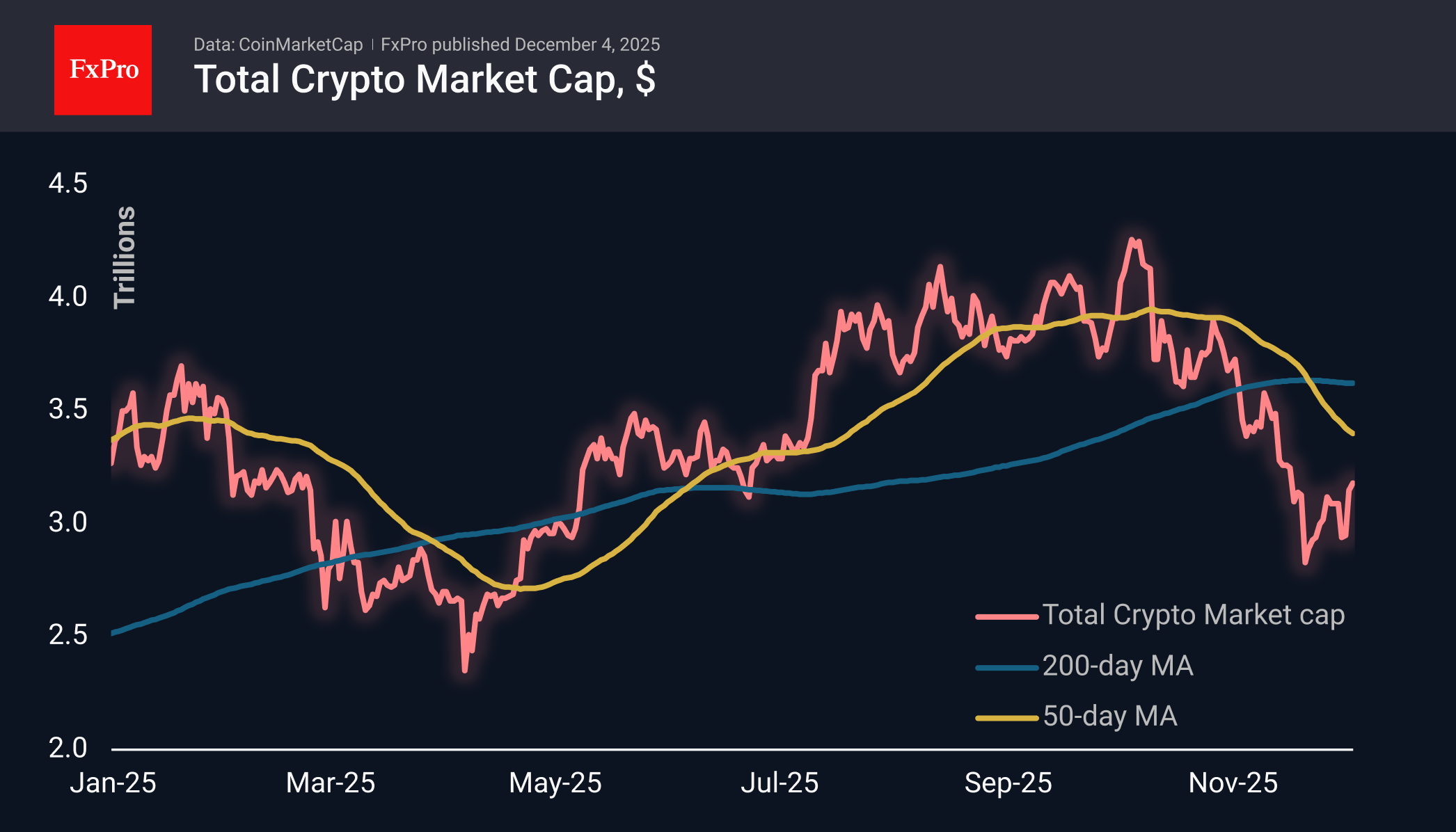

Over the past 24 hours, the crypto market regained another 1% of its cap, rising to an estimated $3.2 trillion and continuing the recovery trend that began almost two weeks ago after seven weeks of selloffs. Among the key altcoins, Ethereum stands out with a 4% growth rate, while Zcash experiences twice as strong growth. XRP is among the laggards at the top, with a 1% loss, and Sui has a 5% drop.

Bitcoin tested the $94K mark at the start of the day. It remains below this figure for now, but the resistance from bears is not yet too aggressive. It is likely that even for bears, the current levels are not attractive for a new downward move. We expect rather sluggish resistance up to the $98-100K area. However, the outcome of the further struggle will be indicative, answering the question of whether crypto winter has arrived or not.

News Background

The ratio of market purchases and sales of the first cryptocurrency on exchanges has risen to 1.17, the highest level since January 2023, according to CoinCare analyst. The indicator tracks the balance of aggressive orders in the perpetual futures market.

The boom in companies with digital assets on their balance sheets (DAT) has come to an end, according to Bitwise. The demand for Ethereum from corporate treasuries declined by 81% between August and November.

Community members estimate the probability of a ‘crypto winter’ at only 7%, according to data from the Myriad prediction platform. Until recently, the indicator reached 30%.

The Chicago Mercantile Exchange (CME) has launched an analogue of the VIX volatility index for Bitcoin. The tool will track the implied volatility of bitcoin futures options, showing traders’ expectations for price fluctuations over the next 30 days. Benchmarks for Ethereum, Solana and XRP will also be launched.

According to Arkham Intelligence, the Ethereum blockchain set a record by processing 32,950 transactions per second (TPS). The figure broke last week’s record of 31,000 TPS, achieved through the integration of the second-layer solution Lighter.

The FxPro Analyst Team