Market Picture

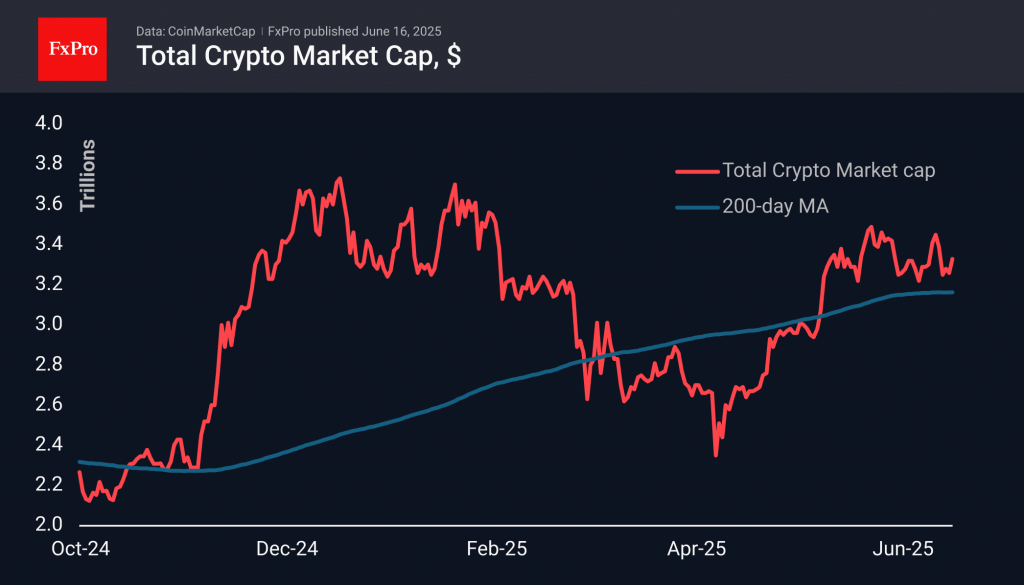

The Crypto Market cap stood at $3.34 trillion on Monday morning, up 2% over the past 24 hours, confirming a rebound from the support line of recent weeks near $3.2 trillion. The crypto market is being actively bought up against the backdrop of positive dynamics in key global stock indices. It cannot be said that the world has awakened an appetite for risk, but there is no reason to talk about a sustained drive for safety yet.

Bitcoin is up 1.7%, lagging major altcoins such as Solana (+7.8%) and Ethereum (+4.1%) in terms of growth. After finding support on the decline in the $104K area, near which the 50-day moving average also passes, BTC confirmed its commitment to the upward trend. However, resistance at $110K proved too difficult for the bulls in May and early June. Will they manage to consolidate above the current momentum? We will find out this week.

Ethereum has gained 5% since the start of the day on Monday to $2,630, having been trying to break through the 200-day average for over a month. The best attempt during this time was last week, with an update of 4-month highs on 11 June. Over the weekend, we again saw active support on declines below $2,500. Paradoxically, the positive market sentiment is working in favour of bulls in cryptocurrencies.

News Background

Inflows into spot Bitcoin ETFs in the US resumed after two weeks of small outflows. According to SoSoValue, net inflows into spot BTC ETFs last week amounted to $1.37 billion, reaching $45.61 billion since Bitcoin ETFs were approved in January 2024.

Net inflows into spot Ethereum ETFs in the US rose to $528.1 million last week. Total net inflows since the ETF’s launch in July have risen to $3.85 billion.

The growing popularity of corporate reserves in Bitcoin poses a systemic risk to the crypto market, Coinbase notes. Already, 234 firms hold a total of 820,542 BTC. During periods of market stress, they may face the need for forced sales to cover liabilities and further depress the price.

Bitcoin mining difficulty has paused its growth, retreating slightly from its historic high of 129.98 T reached two weeks ago.

The e-commerce platform Shopify, in partnership with Coinbase and Stripe, has added the ability to accept payments in Circle’s USDC stablecoin.

Cardano founder Charles Hoskinson proposed allocating $100 million in ADA tokens from the project’s reserves to purchase Bitcoin and stablecoins to boost the DeFi segment of the network.

The FxPro Analyst Team