Market picture

Bitcoin moved between $16.3K and $17.0K on Wednesday and is changing hands Thursday morning closer to the lower bound of yesterday’s range. Some pressure on crypto comes from more wary financial markets, where major indices are down. The total capitalisation of the crypto market has fallen by 1.7% to $830bn in the last 24 hours. However, the overall quieter trading pattern should be noted after the surge in volatility in recent days.

Crypto Fear and Greed Index was down 3 points to 20 by Thursday and remains in a state of “extreme fear”.

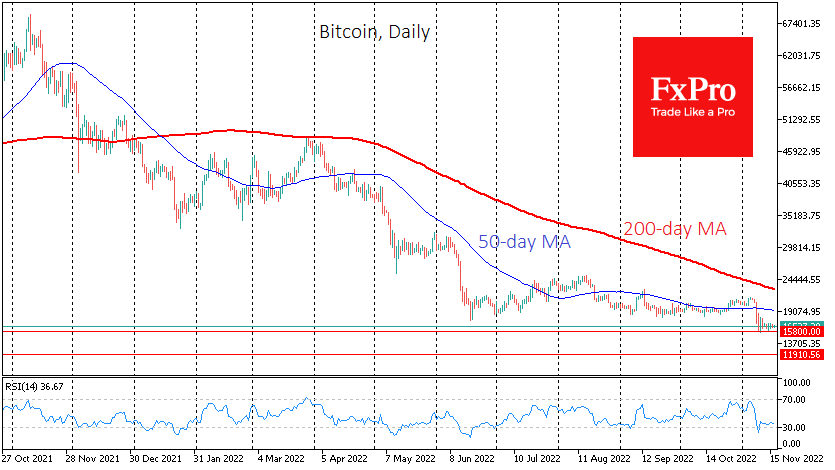

On the technical analysis side, Bitcoin’s failure to cross $17.0K looks like a corrective rebound to lock in profits before a new round of declines. This scenario will only become main after the price approaches local lows near $15.8K, opening the way to $12K.

Ethereum is under more pressure, forming a sequence of declining intraday extremes. At the current price near $1200, we can see the dam-breaking effect at levels below $1100.

A similar pattern is seen in the overall cryptocurrency market capitalisation chart, where we see local reversals from lower levels.

News background

According to The Wall Street Journal, crypto lending platform BlockFi is preparing to file for bankruptcy. The company has acknowledged significant exposure to the FTX exchange. Last week BlockFi suspended customer withdrawals.

The collapse of FTX affected too many companies, which could extend the crypto winter to the end of 2023, according to cryptocurrency exchange Coinbase. Many institutional funds are stuck on FTX, causing increased distrust in the industry. Stablecoins dominance has reached a new high of 18%.

Bitcoin will fall heavily in November and hit “the bottom”, forecasts Pantera Capital’s crypto fund. BTC will then rise to $36,000 ahead of the next halving in March 2024 and continue to grow to a new record peak of $149,000.

According to the average results of a survey conducted by BDC Consulting among 53 cryptocurrency executives, bitcoin will stop the decline at $11,479. Meanwhile, over half of top executives intend to increase their investments in cryptocurrencies and have no plans to cut back.

The FxPro Analyst Team