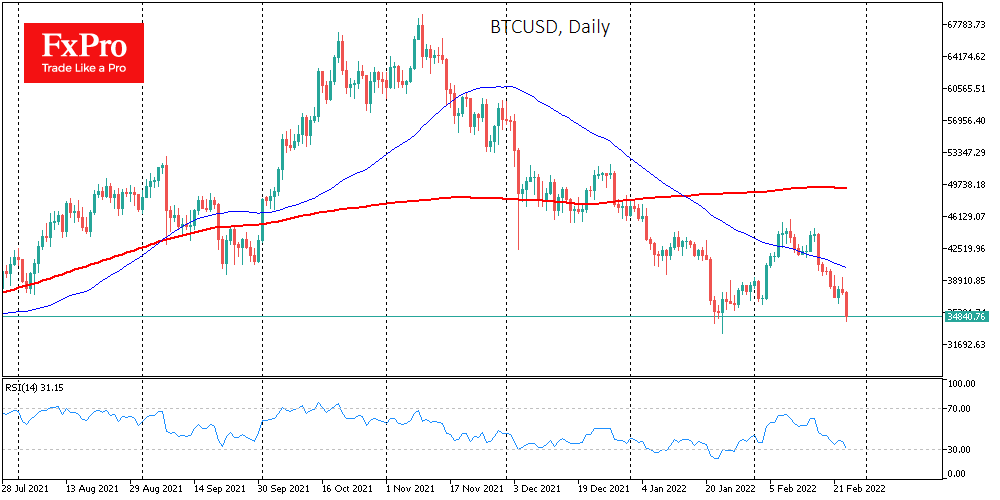

The cryptocurrency market has lost 11% in the past 24 hours, and as the situation develops and investors from Europe and America join the trading, the focus of the decline shifts from Bitcoin to altcoins. At the time of writing, losses of the former cryptocurrency are close to 10%, while ETH, XRP are down 13-14%. Cardano, Avalanche, Dogecoin have even bigger losses, with declines of more than 17%.

Right now, the markets have the highest demand for liquid instruments, making Bitcoin slightly less of a risk than altcoins. It is likely that a further deterioration in the financial situation could benefit the first cryptocurrency as a means of capital savings for investors from Ukraine, Russia, and some nearby countries, mainly CIS.

At the same time, the continued flight from risky assets, including equities, could temporarily destabilise altcoins, so it is possible that we will see double-digit losses in altcoins more than once in the coming days. When the dust settles, prices may prove attractive for long-term investments, but for now, the risks are excessive.

According to Glassnode, the wallets of long-term investors (hodlers) hold record volumes of BTC (76.5%). The volume of bitcoins, which have been without movement for more than 10 years, is also growing (12.6%). Thus, almost 90% of all currently available coins are out of the market.

Now another country besides El Salvador may accept bitcoin as a means of payment. Senator Indira Kempis is developing a bill on cryptocurrencies and intends to convince the Mexican government to follow the “Salvadorian scenario” by recognizing BTC as a means of payment.

Former SEC official Joseph Hall called the department’s chances of losing the lawsuit against Ripple high. The regulator accuses the company of selling unregistered securities under the guise of XRP tokens.

The FxPro Analyst Team