Market Picture

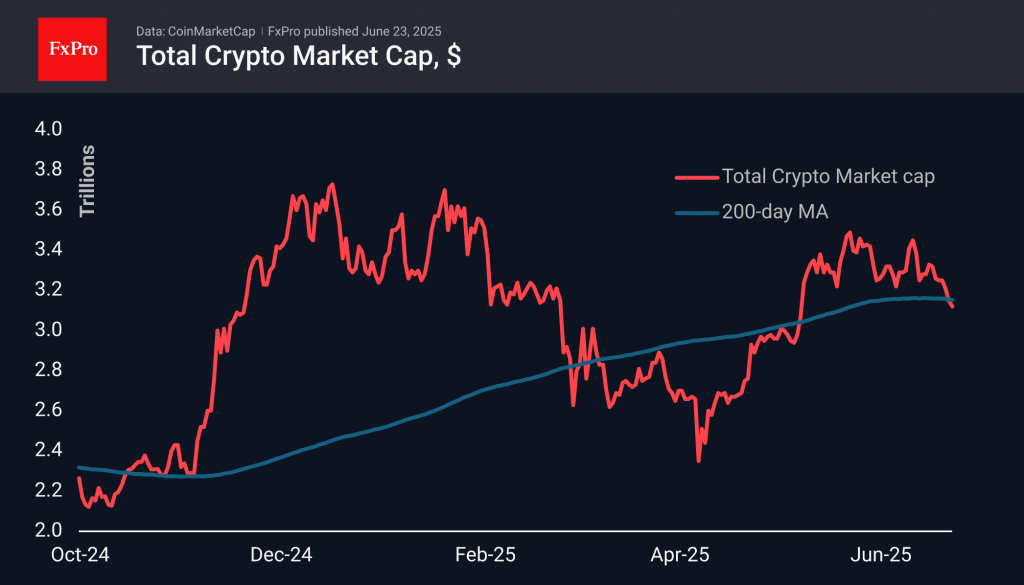

Market capitalisation fell to $3.03 trillion over the weekend, which is easier to attribute to the expectations of speculators working over the weekend that the markets would sell off due to US strikes on targets in Iran. However, the limited reaction of traditional financial markets brought buyers back to crypto, showing their interest in buying at a discount and returning capitalisation to $3.12 trillion.

The cryptocurrency sentiment index fell to 42 on Sunday, its lowest level in two months, but rose to 47 at the start of the new week, jumping out of the fear zone into neutral territory.

Bitcoin slipped to $98K over the weekend. This was a touch of the classic support at 61.8% of the April-May rally, but at the start of the European trading session, it was already close to $102K, compared to $102.7K at the start of the day on Sunday. However, last week’s sell-off broke the support at the 50-day moving average under the weight of external circumstances. Breaking out of the $96–105K range will force us to wait for further movement in the direction of the breakout.

News Background

According to SoSoValue, net inflows into spot BTC ETFs fell to $1.02 billion last week. Total inflows since the approval of Bitcoin ETFs in January 2024 have increased to $45.61 billion.

Net inflows into spot Ethereum ETFs in the US fell sharply to $40.2 million last week, bringing the cumulative net inflow since the ETF’s launch in July to $3.89 billion.

Glassnode noted a drop in the daily number of transactions on the Bitcoin network and largely attributed it to the collapse of non-financial transactions and the growing dominance of large players.

South Korean authorities presented a roadmap for the approval of spot cryptocurrency ETFs. Measures to launch crypto ETFs will be prepared in the second half of 2025.

The Kraken exchange launched Bitcoin staking in collaboration with the BTCFi project Babylon. The integration will allow customers to receive rewards without using bridges or ‘wrapped’ assets. According to the statement, customers will retain full control over their coins, which will not leave the BTC blockchain.

The FxPro Analyst Team