Market picture

The crypto market cooled off on Thursday afternoon, but on Friday morning, buyers stepped up again, bringing capitalisation back to levels from the day before at $2.39 trillion. Strong growth was followed by rapid profit-taking, which is a necessary part of healthy growth, suggesting a high chance of continued gains in the coming days.

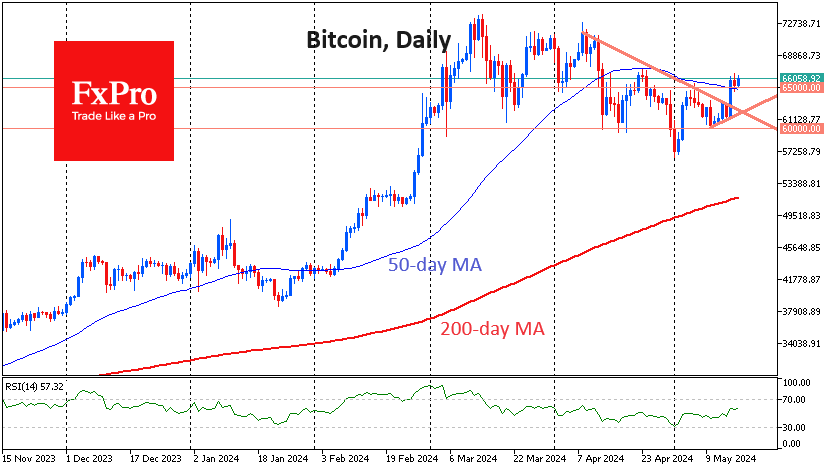

Bitcoin was pulling back towards $65K on Thursday but is already trying to regain its footing above $66K on Friday morning. If cryptocurrencies get support from the global risk appetite on Friday, Bitcoin could exceed $70K over the weekend. A test of the $71K-$74K highs area, in our view, could happen as early as early next week, triggering a new episode of FOMO.

Solana has been revived, adding over 10% in less than three days. On Thursday, the coin managed to break out of the $125-155 consolidation range. The day before, it consolidated above the 50-day moving average. Potentially, this opens the way to $200, and this is a case where altcoins are moving better than Bitcoin.

News background

According to the company’s report, hedge fund Millennium Management owned $1.94bn worth of spot bitcoin-ETFs at the end of the first quarter of 2024, which corresponds to 3% of its assets under management.

In the first quarter, 937 companies invested $11bn in bitcoin-ETFs, K33 calculated based on summary reporting information to the SEC. On 15 May, net inflows into spot bitcoin-ETFs rose to $303 million. The positive trend continued for the third day in a row.

According to Bloomberg, there is almost zero probability that the US SEC will approve spot Ethereum-ETFs. Ethereum’s exchange rate against Bitcoin has fallen to a three-year low.

According to the FT, the world’s largest financial derivatives exchange, CME Group, plans to launch spot trading in Bitcoin in addition to its existing futures product. The exchange would then become another channel for Wall Street companies to trade Bitcoin in addition to ETFs.

Tether, the company that issues USDT, has partnered with The Open Network and the Oobit service to “create a seamless cross-chain payments solution.” This could expand the use of crypto assets as a means of payment for people without access to banking services.

Major cryptocurrency exchanges Binance, Bybit, and OKX all listed the NOT token of gaming Web3 project Notcoin on 16 May. The coin will also be added to Telegram’s built-in crypto wallet, Wallet. The project attracted users’ attention due to the announced coin distribution.

The FxPro Analyst Team