Market Picture

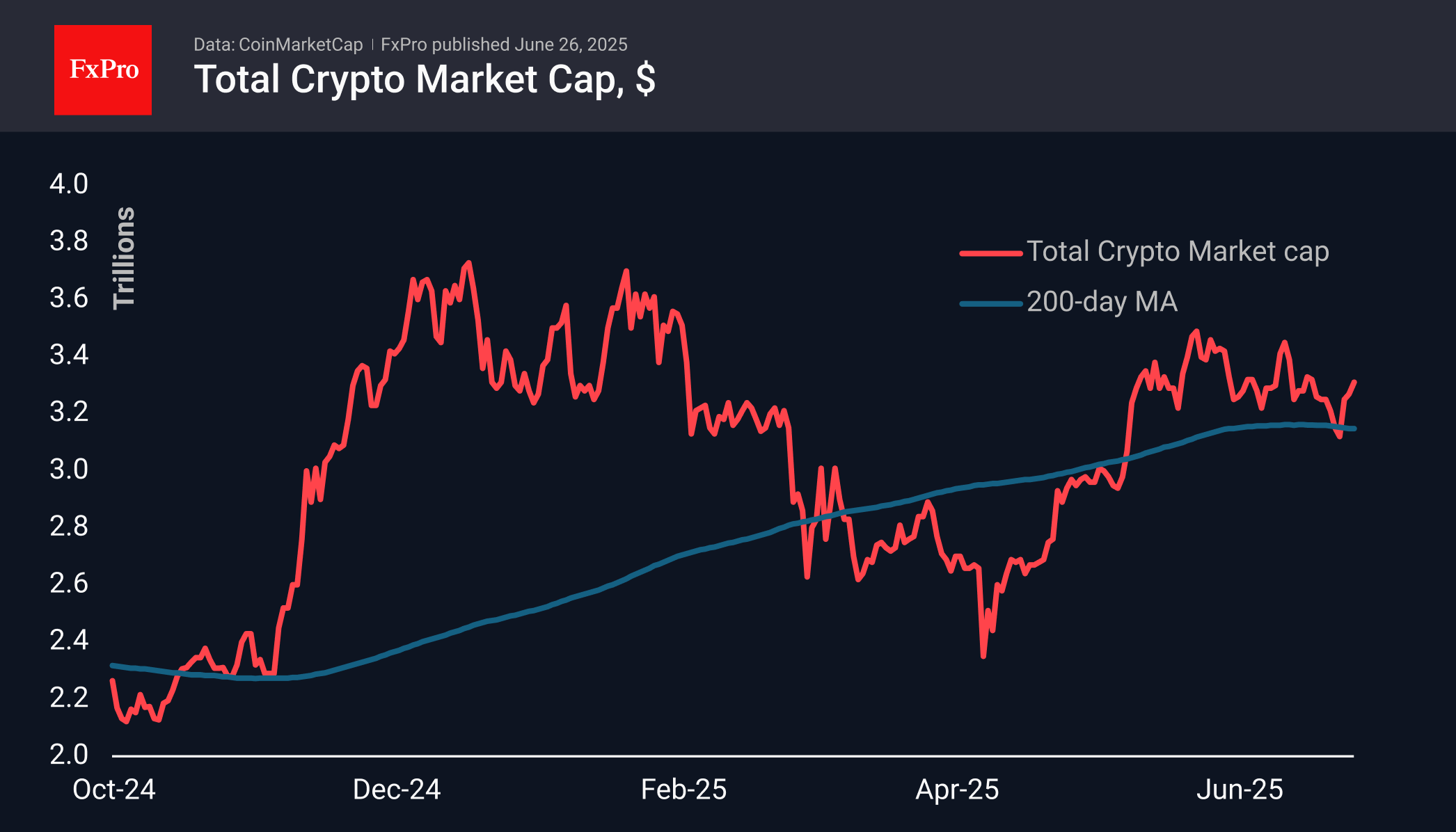

The crypto market cap increased by another 1% to $3.31 trillion, reaching the threshold of increased volatility. Just above that, in the $3.40–3.55 trillion range, is a turning point, which has activated sellers and prevented the market from consolidating higher.

The cryptocurrency sentiment index is at 74, just 1 point below the ‘extreme greed’ zone and in the range of the highs of the second half of May. At that time, the market capitalisation was at approximately the same level.

Since the end of Wednesday, Bitcoin has been testing the $108K mark, but it will sell off when it touches this level. Over the past couple of days, we have seen a smooth but steady intraday uptrend, accompanied by heavy buying from medium—and long-term investors. We see this as a sign of buying by professional market participants and link it to strengthening stocks, which increases the likelihood of reaching $110K or even $112K as early as this week.

News Background

Inflows into Bitcoin ETFs continue to influence the price of the first cryptocurrency, while companies’ purchases for their Bitcoin reserves have virtually no impact, according to K33. Experts warn of likely high volatility in the crypto market due to Trump’s upcoming budget bill and the 9 July tariff deadline.

According to The Block, the Bitcoin dominance index, which reflects its market share compared to other crypto assets, rose to 62% after falling to 59% in May. This raises questions about the onset of the altcoin season.

Fed Chair Jerome Powell said the US needs a regulatory framework for stablecoins. The GENIUS Act, passed by the Senate last week, is awaiting consideration in the House of Representatives.

Barclays, one of the UK’s largest banks, has banned its customers from buying cryptocurrency with Barclaycard credit cards. The bank said that falling cryptocurrency prices could lead to debts that customers would be unable to repay.

Tether CEO Paolo Ardoino said the company could become the largest Bitcoin miner by the end of 2025. According to him, the company’s goal is not commercial gain but protecting its assets. The company owns more than 100,000 BTC and wants to participate in securing the network to protect these investments.

The FxPro Analyst Team