Market Picture

The crypto market cap added another 1.5% overnight to $1.34 trillion as the corrective reset quickly turned to buying. Bitcoin is up 2%, while Solana and Chainlink are up 6%. This pair also led the gains over the past 30 days, indicating robust demand for them. In contrast, BNB loses 0.6% in 24 hours and adds 17% in 30 days.

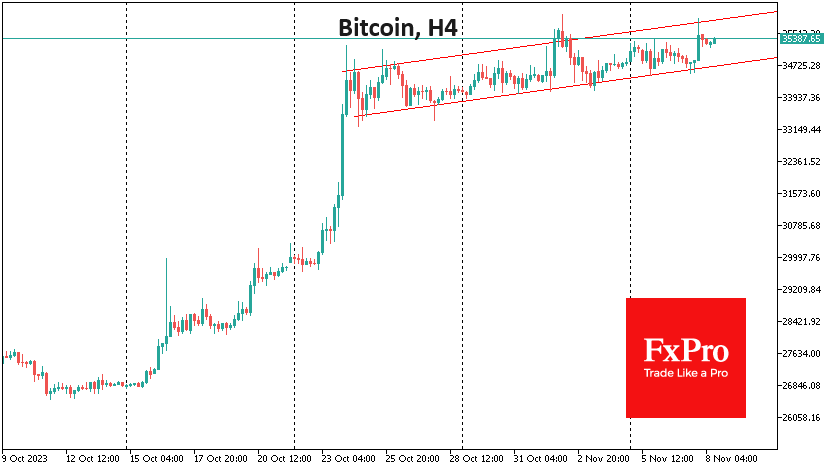

Bitcoin continues to trade in a bullish corridor, finding buyers on dips from slightly higher levels. A second failed attempt at $36,000 on Tuesday night suggests that most players are not looking to accelerate, further confirming a shift in focus to altcoins.

Solana has returned to growth quickly after a period of pressure earlier this month. At $43, it is trading close to a 15-month high. A locally important milestone for the coin could be the $48 level. An easy break of this level would open a direct path to $75.

News Background

The US Securities and Exchange Commission (SEC) is having difficulty hiring crypto experts because the right people are unwilling to sell their digital assets. This is according to a report from the agency’s Office of the Inspector General.

The capitalisation of the largest stablecoin, Tether (USDT), is up 22% since January to $85.42 billion, according to IntoTheBlock, and Tether has accumulated up to 69% of the funds placed in the real collateralised digital currency market, according to DeFiLlama.

Germany’s third largest bank, DZ Bank, announced the launch of its digital asset custody platform. The bank plans to offer institutional investors and private clients the opportunity to buy cryptocurrencies.

Rein Lõhmus, a co-founder of Estonia’s LHV Bank, lost the password to a wallet containing 250,000 ETH (over $473 million) and plans to use artificial intelligence to recover it.

The FxPro Analyst Team