Market Overview

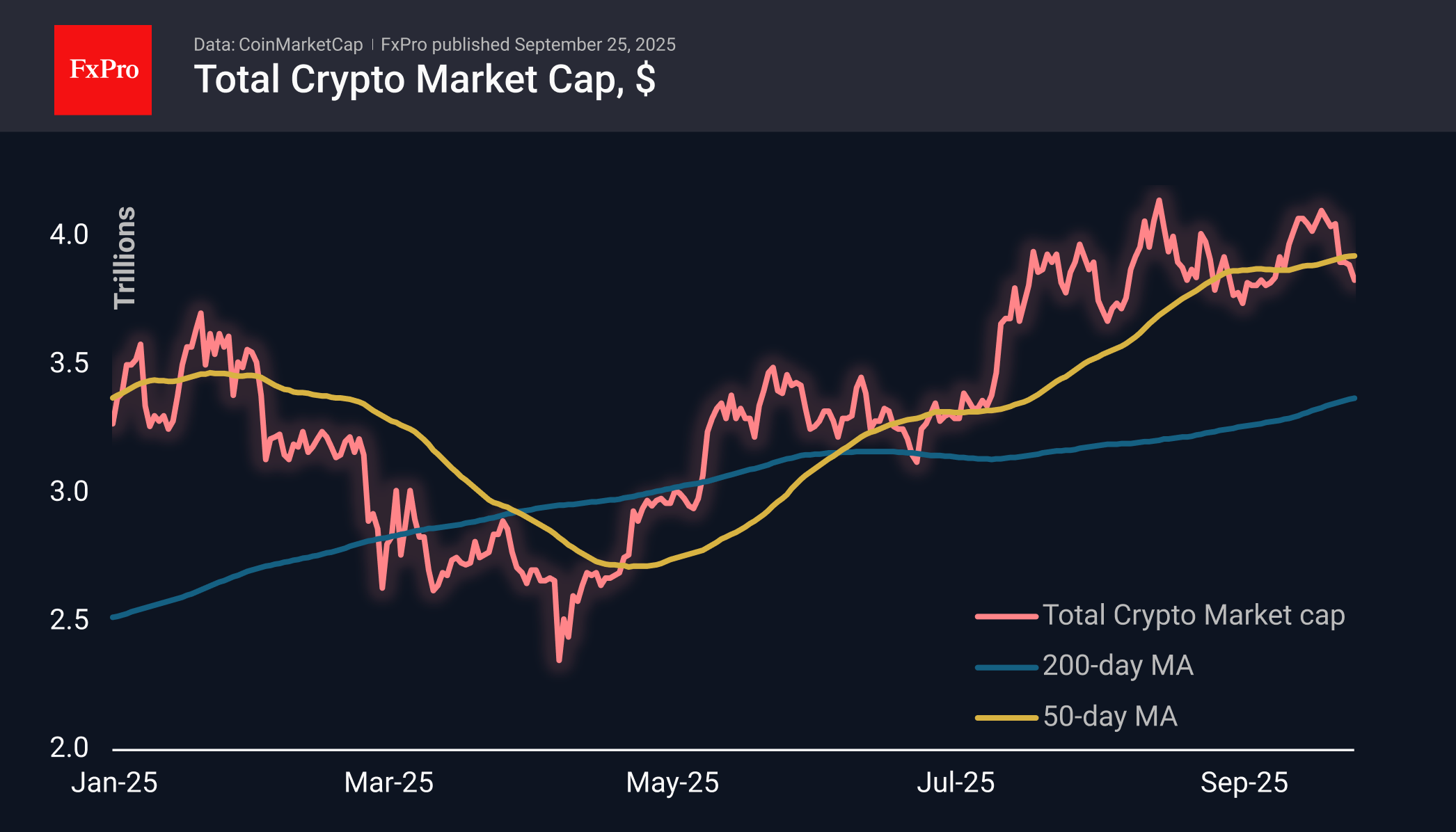

The crypto market capitalisation has fallen to a nearly three-week low of $3.83 trillion, falling deeper below its 50-day moving average. However, similar declines at the end of June and the end of August only encouraged buyers. On Thursday morning, Bitcoin wiped out the previous day’s gains, while major altcoins, Ethereum, and Solana, have been declining for the fifth trading session in a row.

The sentiment index at 44 barely touches the fear zone, preventing us from talking about a full-fledged reversal in sentiment. Nevertheless, we are once again turning our attention to crypto as an early indicator of risk appetite. Altcoins, as well as small currencies of developed countries, have been losing ground since the Fed cut rates a week ago, and key US indices have joined them since Tuesday.

On Wednesday, Bitcoin unsuccessfully attempted to storm the 50-day moving average. Earlier, BTCUSD fell out of the upward channel that had been forming since early September. These are all signs of a deeper dive ahead, potentially into the $104-107K range.

News Background

Bitcoin’s implied volatility has fallen to its lowest level since 2023. Blockchain data points to a “calm before the storm,” according to XWIN Research. The last time this happened, it was followed by explosive growth.

CoinW also calls the situation “the calm before the storm.” Negative funding rates, seasonal trends, and inflows into institutional ETFs tip the odds in favour of growth. According to CoinGlass, Bitcoin has strengthened in October in 10 of the last 12 years.

If US inflation turns out to be moderate, the Fed’s rate will be further reduced, and the amount of liquidity in the market will increase. According to QCP Capital, this factor will be the main driver of Bitcoin’s growth in October.

However, JPMorgan CEO Jamie Dimon believes that the Fed is unlikely to cut its key rate. He sees factors that are more likely to cause inflation to rise than fall.

SkyBridge Capital founder Anthony Scaramucci confirmed his previous forecast that Bitcoin will reach its target of $150,000 by the end of the year. In his opinion, November-December is the most favourable period for buying BTC.

Pantera Capital CEO Dan Morehead said BRICS countries, including Russia and China, view Bitcoin as a tool for de-dollarisation. In his opinion, these countries will prepare to create state Bitcoin reserves and their own Bitcoin ETFs.

The FxPro Analyst Team