Market Overview

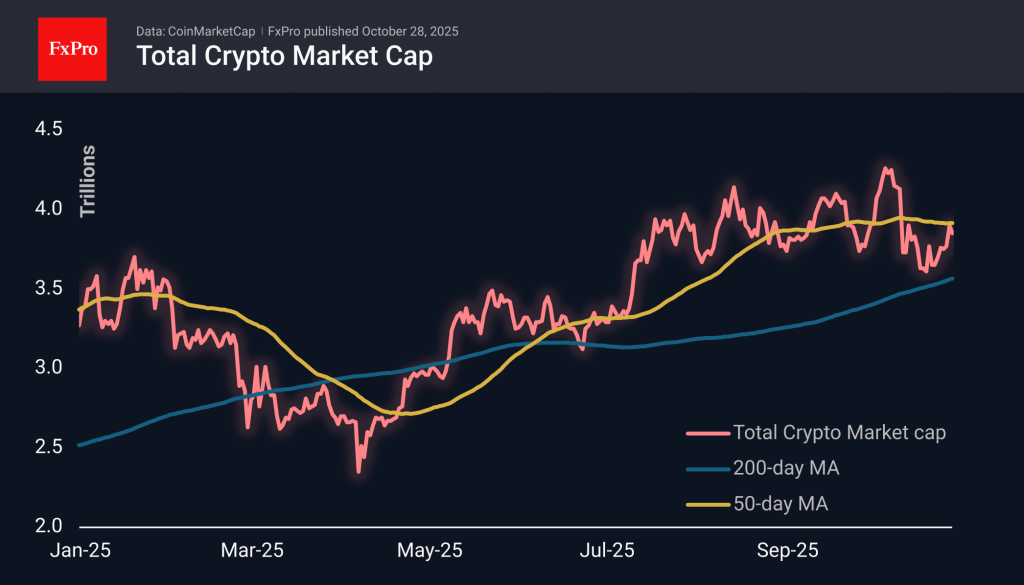

The crypto market cap fell by 1.7% to $3.85 trillion in 24 hours. External conditions are a mixture of new highs in stock indices and a rapid sell-off of gold, confusing cryptocurrency investors. The Trump coin is up about 10% daily, likely fuelled by negotiations in Asia. Zcash, among the day’s outsiders, is down 9% but still showing 500% growth over 30 days.

Bitcoin has fallen back to $114K, remaining stuck to the 50-day moving average. At the start of the week, there was an attempt to break out of the range defined by the 50- and 200-day moving averages. The price pullback at the end of Monday does not allow us to declare victory for the bulls. If Bitcoin is still digital gold, this is bad news for buyers.

Ethereum is trading near $4,100. Attempts to break above $4,200 and overcome resistance in the form of the 50-day average on Monday were unsuccessful. Since August, ETHUSD has been on a downward trend with lower local lows and highs. We can only discuss a break in this trend after it consolidates above $4,300.

News Background

According to CoinShares, global investment in crypto funds rose by $921 million last week after an outflow the week before. Investments in Bitcoin increased by $931 million, XRP by $84 million, and Solana by $29 million. Investments in Ethereum decreased by $169 million, and Sui by $9 million.

Bitcoin has returned above the short-term holders’ cost basis (STH-Cost Basis), which is a constructive signal for a bull market, according to Checkonchain.

Since mid-October, long-term investors have withdrawn about 62,000 BTC from their wallets. The growth in market supply could hinder Bitcoin’s rally in the absence of intense demand, according to Glassnode.

BitMine increased its reserves to 3.3 million ETH, buying 77,055 ETH over the past week. BitMine’s total cryptocurrency reserves reached $14.2 billion.

Strategy bought 390 BTC over the past week. The company now has 640,808 BTC on its balance sheet, with a total value of $47.44 billion at an average purchase price of $74,032.

The bankrupt crypto exchange Mt.Gox has postponed the deadline for payments to creditors from 31 October 2025 to 31 October 2026. This is the third postponement of payments, which were initially planned to be completed by 31 October 2023.

The FxPro Analyst Team