Market Picture

Despite a mid-week spike in volatility, the cryptocurrency market remained virtually unchanged from the previous week’s capitalisation level, hovering around $1.050 trillion (-1% in 7 days). Bitcoin’s decline was a negligible 0.7%, while altcoins suffered losses of around 2%.

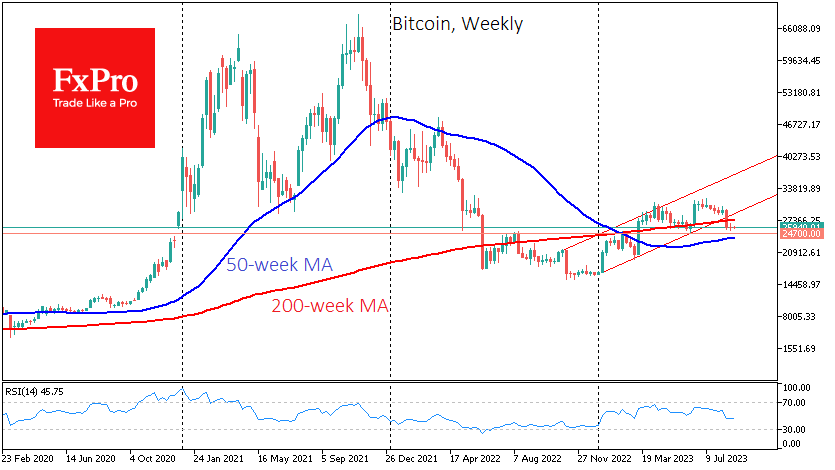

The technical picture for Bitcoin remains bearish on weekly timeframes, as the price is below its 200-week average and outside of its ascending channel. The most likely short-term outlook is for a decline to the $23.9-24.6K region, with the lower boundary being the 50-week average and the upper one being the pivot area from last August.

According to Santiment, large investors continue to accumulate positions. The number of wallets with balances between 10 and 10,000 BTC totalled 156,600, and these accounts have accumulated $308.6 million since the 17th of August.

News Background

Bitcoin and other cryptocurrencies could fall in the short term, although the decline will be limited, JPMorgan warned. The bank said the liquidation of long positions is nearing completion rather than being in its early stages.

Tether has updated its report on the state of reserves providing liquidity to the USDT. The data shows assets exceed $86.1 billion, and liabilities exceed $82.8 billion.

Mastercard and Visa refuse to issue cryptocurrency payment cards for Binance amid the exchange’s regulatory troubles. In March, the CFTC filed a civil lawsuit against Binance. In June, the SEC filed 13 charges against the exchange.

The FxPro Analyst Team