Market Overview

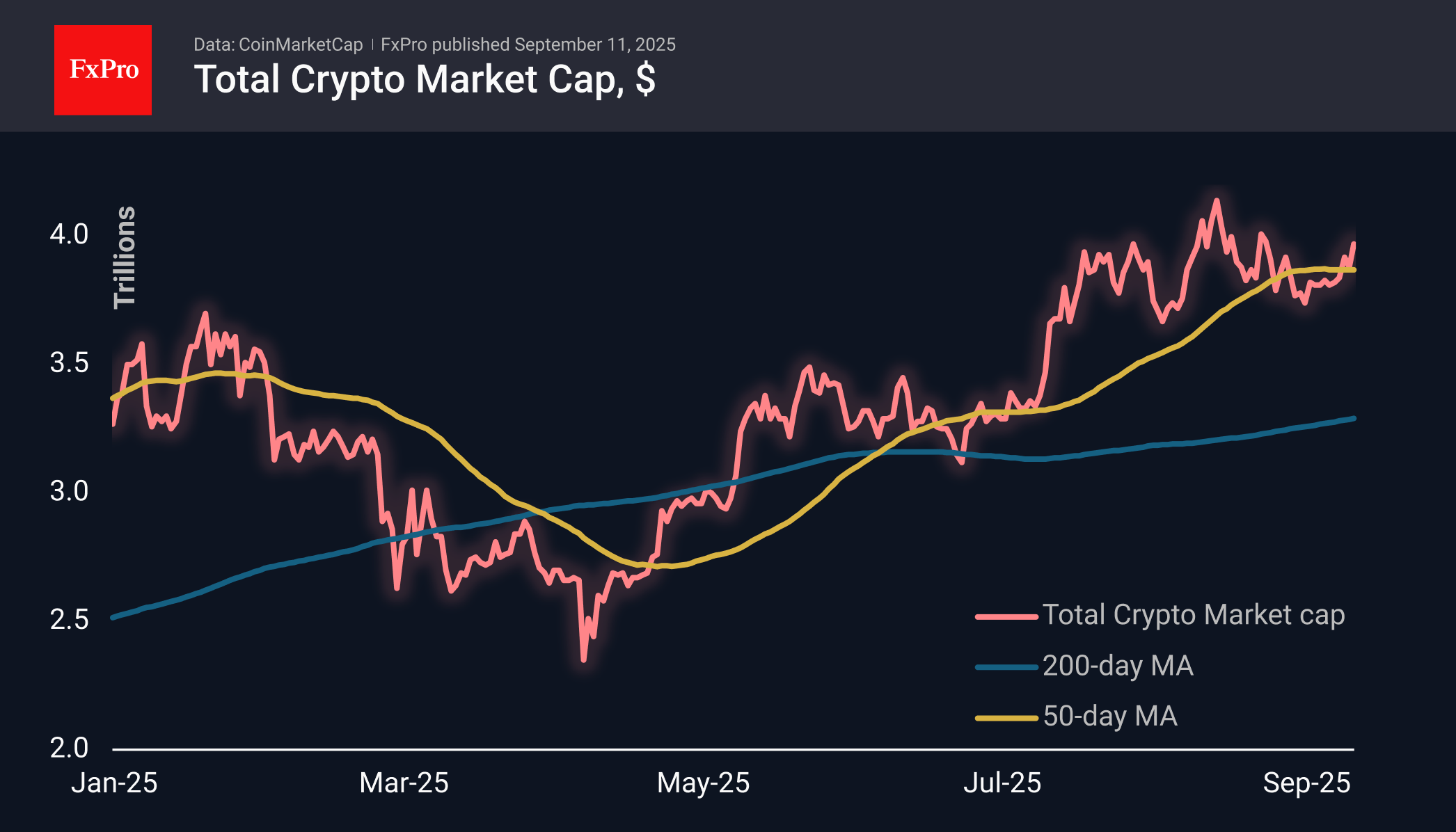

Once again, the crypto market capitalisation has approached $4 trillion, rising by more than 2% over the past 24 hours. The whole market is managing to gain above the 50-day moving average, which the first cryptocurrency is unable to do. There are no super rallies or confetti like before, but these are still signs of an altcoin season with heavy altcoins leading the way.

Bitcoin exceeded $114K on Wednesday for the first time in 2.5 weeks after the release of weak US producer price data. On Thursday, US consumer inflation data will be released, which could also influence interest rate decisions in the coming months, thereby affecting the markets. The BTC price has approached the 50-day moving average, and the upcoming data could provide momentum for both a breakout of this resistance and an end to the recent uptrend.

News Background

According to Santiment, traders have turned negative, expecting Bitcoin to fall to $100K, Ethereum to $3,500 and altcoins to pull back. As markets move contrary to crowd expectations, this pullback may not happen.

Japan’s Metaplanet will allocate $1.45 billion to buy Bitcoin this year. The company has completed its share offering, increasing the volume from 185 million to 385 million shares.

According to Bitwise, banks need to raise deposit rates to compete with increasingly popular stablecoins.

The Kyrgyz Parliament has approved a bill on ‘Virtual Assets,’ which provides for the creation of a state cryptocurrency reserve.

The Vietnamese authorities have approved the launch of a legalised cryptocurrency market in the country on a trial basis for the next five years.

Cardano founder Charles Hoskinson said the Ethereum ecosystem is doomed to collapse in the next 10-15 years due to a large number of fundamental flaws. Among the shortcomings of ETH are an inefficient virtual machine, an incorrect accounting model, and a flawed consensus system.

The FxPro Analyst Team