Market Picture

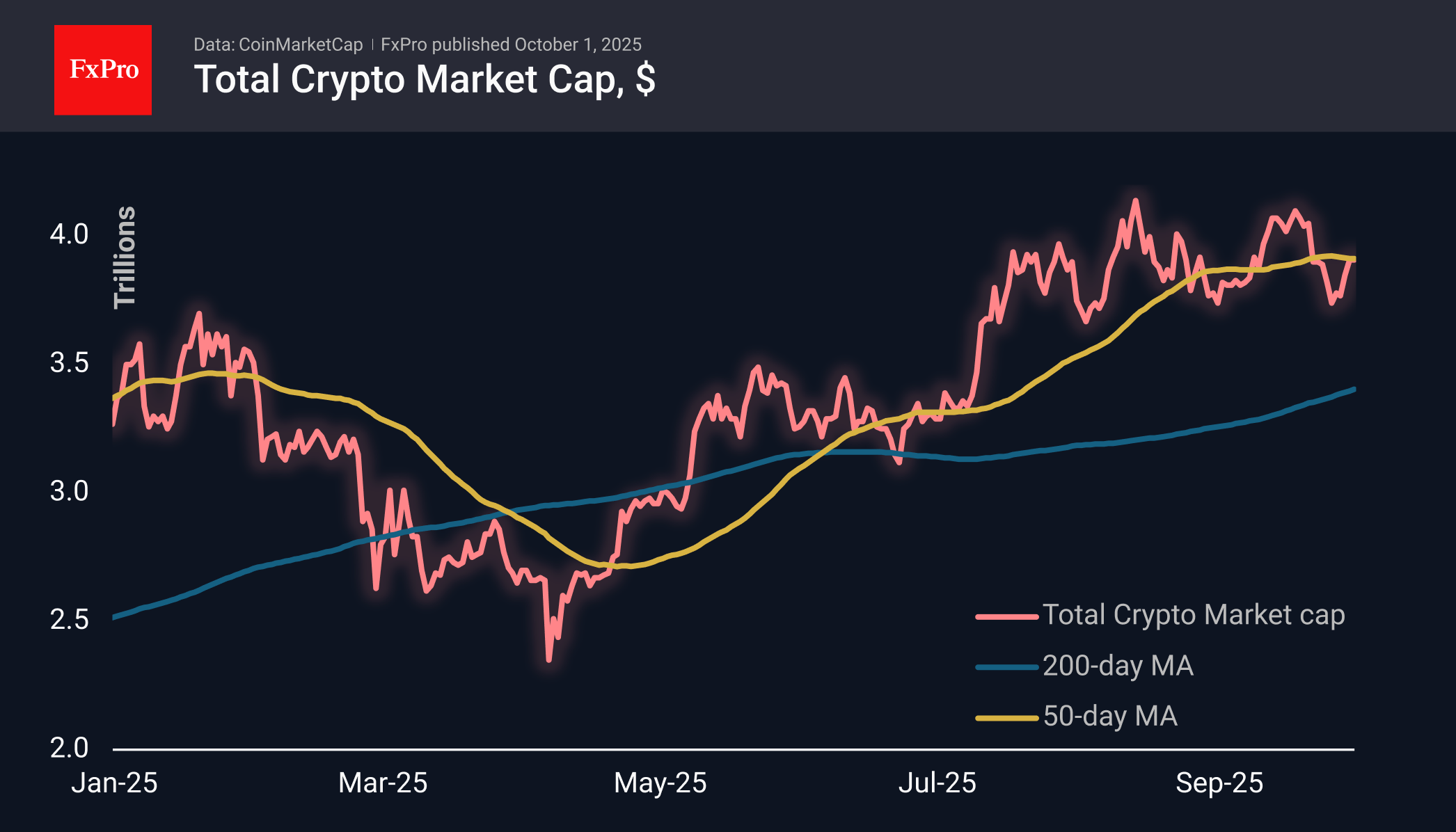

The crypto market capitalisation has remained virtually unchanged over the past 24 hours, staying close to $3.91 trillion and the 50-day moving average. The market has moved away from local lows but prefers to wait for the next catalyst to determine its direction. Labour market data and the resolution of the US shutdown issue promise to help in this regard.

Bitcoin is trading above $114.4k, trying to consolidate above its 50-day moving average. The first cryptocurrency is much worse than gold and silver at exploiting the narrative of US financial problems, showing very indecisive growth. Cryptocurrencies are being weighed down by pressure on the stock markets, for which the shutdown is a negative factor.

Bitcoin rose 6.1% in September to $114.6k, defying the seasonal trends of one of the two worst months of the year. In recent days, BTC has managed to approach the highs of the middle of the month.

From a seasonal perspective, October is one of the three best months of the year, which is why it is called ‘Uptober.’ Over the past 14 years, Bitcoin has ended this month with growth in 10 cases. The average growth was 27.4%, and the average decline was 15.3%.

News Background

According to Bitwise, the current situation may indicate the end of the decline phase. Sellers appear to be ‘increasingly depleted.’ Upcoming SEC decisions on spot ETFs could be catalysts for growth, according to Bitget Research.

The share of altcoins in the volume of futures trading on Binance reached a historic high of 82.3%, exceeding the peak values of the 2021 altseason, according to CryptoQuant. Traders are increasingly shifting their attention to more volatile assets in anticipation of higher profits.

DePIN tokens of decentralised physical infrastructure networks are not securities and are therefore outside the SEC’s oversight. This is stated in a letter from the regulator addressed to the DoubleZero project.

The FxPro Analyst Team