Market Overview

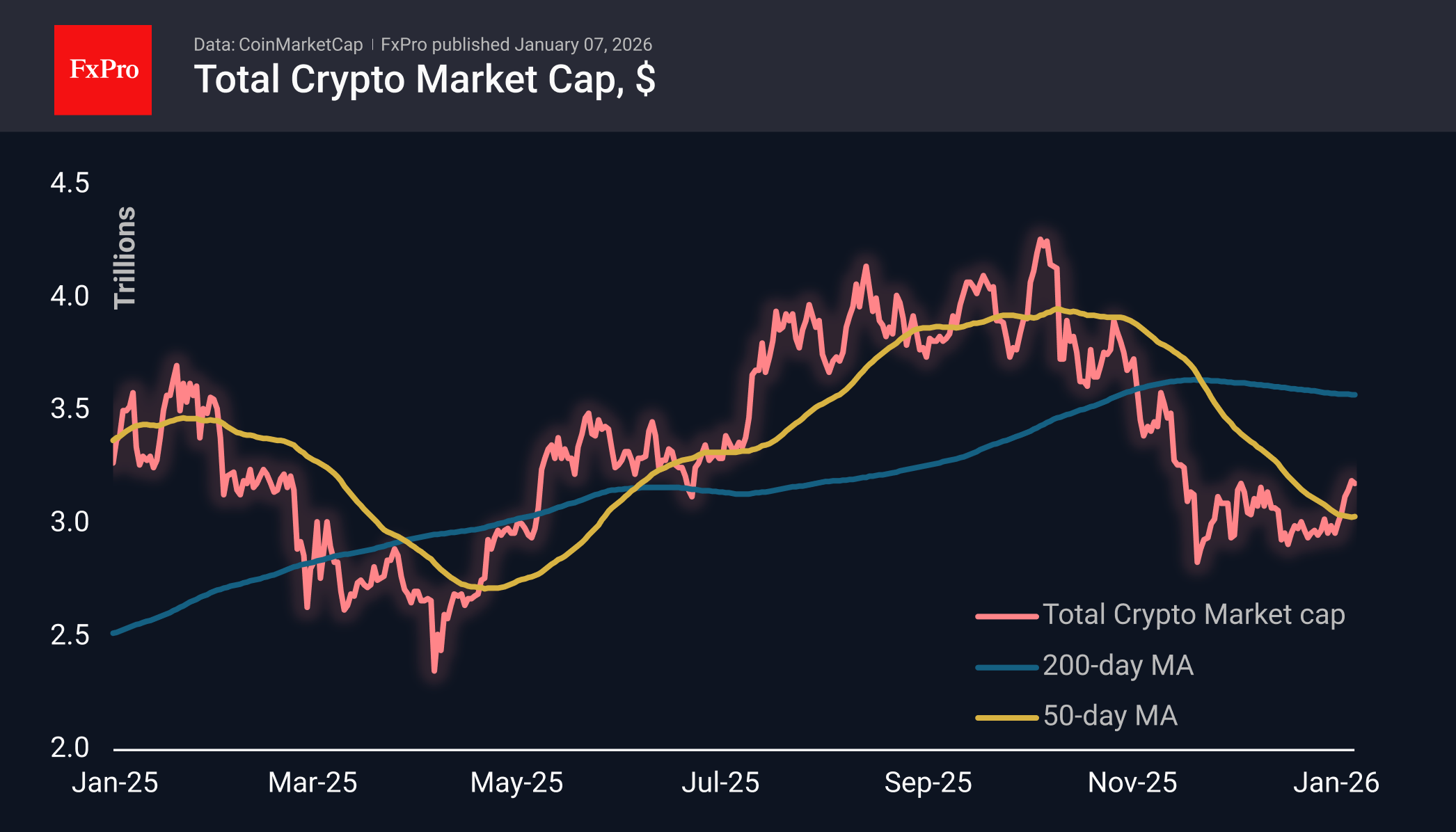

This week’s strengthening of the crypto market has hit local resistance near the $3.2 trillion total capitalisation level. The market recovery in early December also stalled at around these levels, which is why the current level is attracting some cautious sellers. For now, the recovery is being stifled by intense selling pressure, which allows us to remain cautious about the near-term outlook.

The sentiment index has risen sharply over the last two days, buoyed by rising prices, and has returned to neutral territory from the fear zone. Notably, this shift in sentiment has been reflected in altcoins, which have experienced significant price increases since the start of the year.

On Monday and Tuesday, Bitcoin rose to the upper limit of its trading range since mid-November, at $95K, followed by a drop to $91K and a further recovery to $92.6K, where the quotes stand at the time of writing. Clearly, the easy part of the BTC rebound is behind us, and further growth can be seen as a signal of a prolonged recovery, which bears are still strongly resisting.

News Background

The risks of a deep fall in Bitcoin in the current market cycle remain limited, as do the chances of a significant rally. Bitcoin’s four-year cycle remains in place, and 2026 is likely to be a period of consolidation and sideways movement, according to VanEck.

Over the past week, the Binance exchange has recorded the most significant inflow of Bitcoin and Ethereum in a month, amounting to nearly $2.4 billion. The inflow of cryptocurrency may be linked to holders’ desire to sell their assets, according to CryptoOnchain.

The myth that crypto whales are aggressively buying up Bitcoin is not true. Their activity is overestimated due to distortions associated with the work of crypto exchanges, according to CryptoQuant. Exchanges consolidate funds from many small wallets into a few large ones for regulatory reasons, which leads to the misclassification of such activity.

A rare buy signal has appeared on the weekly Bitcoin chart according to the McMillan Volatility Band indicator, said analyst Lawrence McMillan. In the entire history of BTC, such a signal has appeared only three times, and each time it coincided with successful buying points.

According to Token Terminal, the Ethereum network has set a new record for the volume of stablecoin transfers. The figure in the fourth quarter of last year exceeded $8 trillion — in six months, the volume has almost doubled.

Starting this year, crypto services in 48 countries are required to begin collecting information on cryptocurrency transactions. Member states of the Organisation for Economic Co-operation and Development (OECD) intend to exchange this data to increase tax revenues.

The FxPro Analyst Team