Market picture

The financial markets have been under pressure due to the trend of moving out of risky assets as government bond yields rose. Cryptocurrencies seemed to be immune to this trend for a while, but last week, there was a switch to a sell-off mode amid rising US Treasury yields to 16-year highs and fears about China’s debt problems.

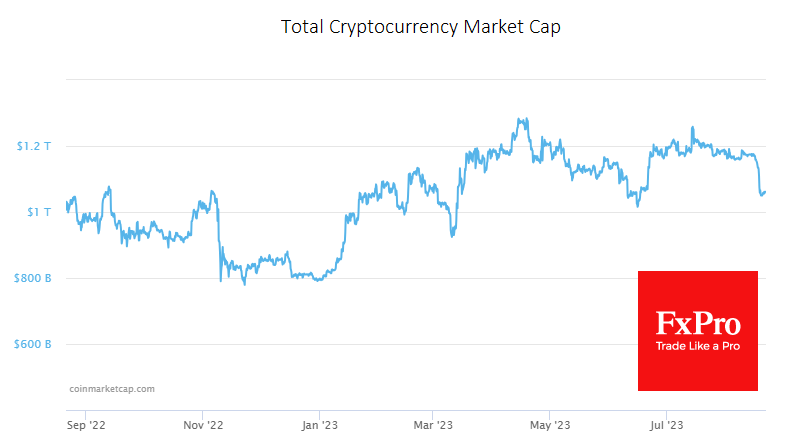

Crypto market capitalisation fell 9.7% last week to stabilise at $1.058 trillion, finding buyers on dips below $1.05 trillion. Technically, the market is still above the previous local lows of June, giving hope for a continued uptrend. However, it is worrying that July’s highs are lower than April’s.

Bitcoin closed the week with a notable drop below its 200-week and 200-day moving averages, signalling a shift to a bearish trend. From current levels near $26.0K, the following area of decline appears to be the last pivot area at $24.7K.

News background

According to JPMorgan, Bitcoin miners are exploring new lines of business ahead of the halving. According to the bank, miners could find it lucrative to provide computing services in the fast-growing artificial intelligence market.

The US Securities and Exchange Commission (SEC) is ready to approve the first applications for Ethereum futures ETFs in October, Bloomberg reported, citing sources. The SEC is now reviewing 11 applications to launch such ETFs.

Payments giant Mastercard has launched a CBDC innovation research partner programme with companies in the blockchain industry, including Ripple, ConsenSys and Fireblocks. Mastercard notes that 93% of the world’s central banks are experimenting with digital currency, and four retail CBDCs are already in circulation.

The FxPro Analyst Team