Market picture

Cryptocurrency market capitalisation fell 3.2% over the past 24 hours to $1,021 trillion, its lowest level since mid-March when cryptocurrencies rallied on concerns about US banks. There is likely to be a reversal now that crypto exchanges have become a target for regulators and the banking system has managed to avoid any new high-profile failures.

Bitcoin started Thursday’s session below $25K (-3.6% in 24 hours), while Ethereum fell to $1640 (-5.4%). Major altcoins are losing between 0.45% (Tron) and 6% (Litecoin).

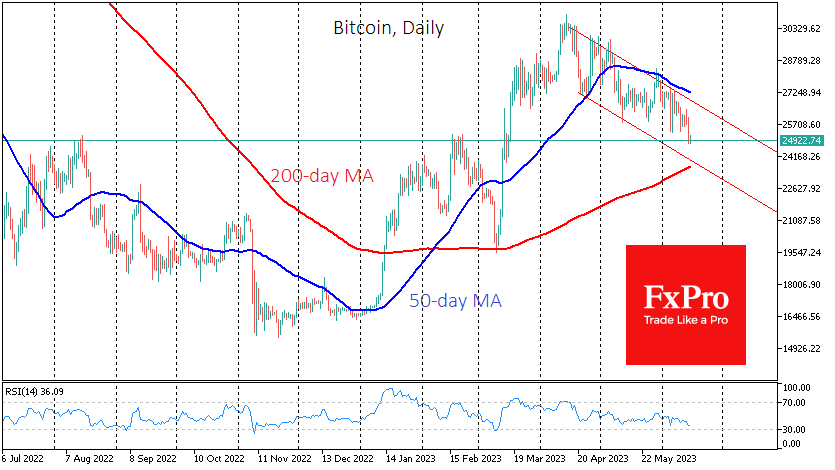

Bitcoin has retreated to local resistance levels from August last year to February this year. The bulls may try to hold the sell-off near this level, but the current decline is still within the descending channel that has been in place since April. More significant support for Bitcoin is near the 200-day average – now at $23.6K and pointing higher.

News background

Michael Saylor, MicroStrategy founder, says the SEC trying to bring regulatory clarity for the crypto market lays the groundwork for a new bitcoin rally. He believes that “confusion & anxiety has been holding back institutional investors.”

The relatively low realisation of gains and losses, coupled with the virtual lack of reaction from holders, suggests that investors are “indifferent” to the SEC’s actions against Binance and Coinbase, Glassnode said. The market reaction has kept Binance’s position as one of the largest holders of BTC and ETH.

The head of the US House Financial Services Committee, Republican Patrick McHenry, said the SEC should have taken strict action against the Binance exchange long ago. He said it should have been shut down years ago.

Mark Cuban, a billionaire, blamed SEC for not having a classification system for cryptocurrencies. Under such circumstances, the regulator can recognise any token as a security.

Binance CEO Changpeng Zhao denied rumours of market manipulation to inflate BNB’s value by selling Bitcoin.

The FxPro Analyst Team