Market Picture

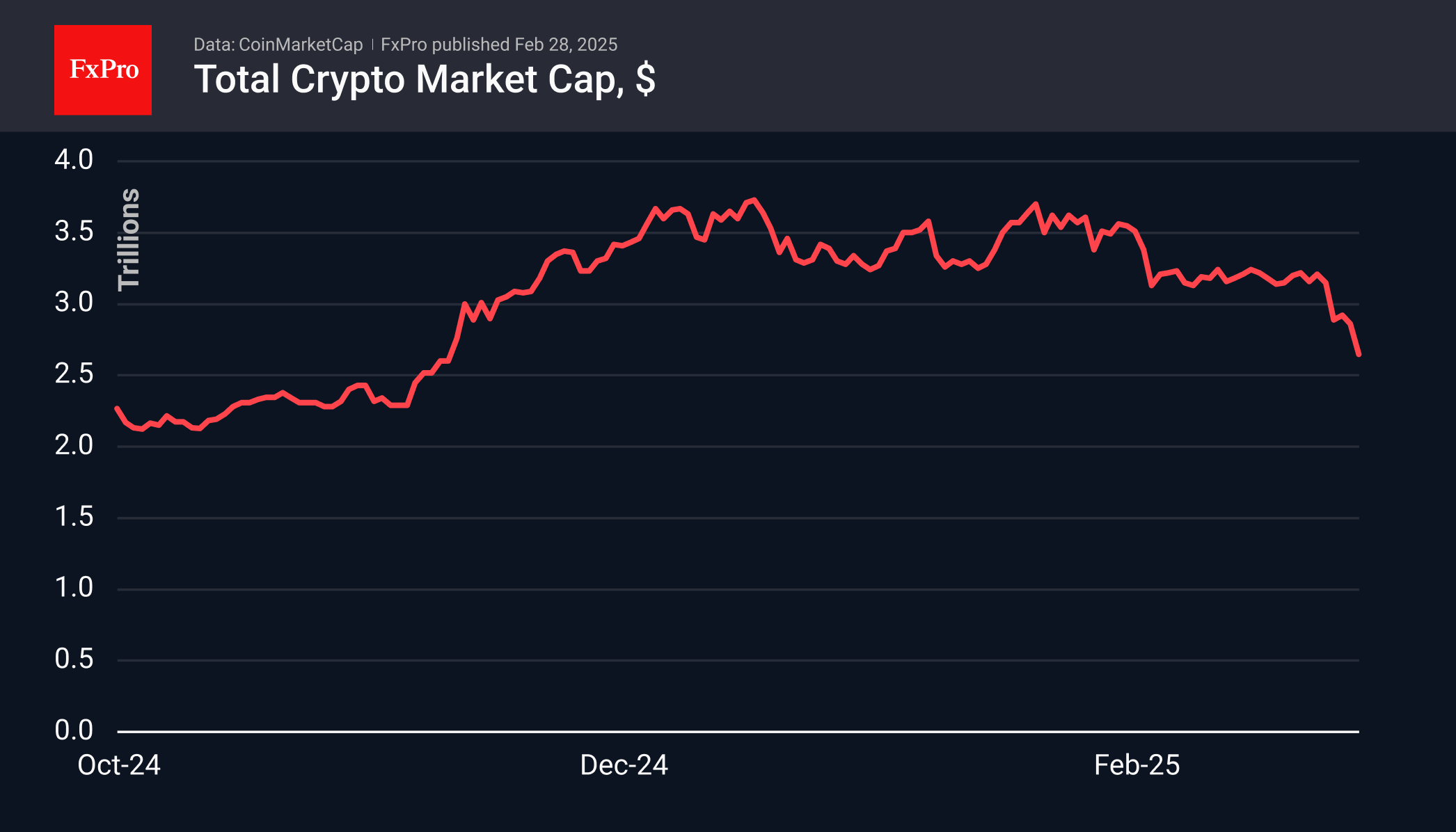

Crypto market capitalization collapsed by 7.5% in the last 24 hours to $2.65 trillion, the lowest level since November 10th. Unlike the dynamics of the previous two days, there was no rebound at the beginning of Friday; there was just a timid attempt at consolidation. It seems that the market has found the pain point of short-term buyers, knocking out the “weak hands.”

Bitcoin has lost 8.6% over the last day, having pulled back under $79,000. The formal bearish trend boundary and the 200-day moving average remain above the current price level. Bitcoin will completely nullify Trump’s rally if it pulls back to the $70K area, which has acted as resistance for most of the past year. Going below will not be easy—the market is too oversold.

Ethereum has pulled back below $2100, trading in the area of last year’s lows and attempting to break lower. This bad news is amplified by the “death cross,” a bearish signal that occurs when the 50-day moving average dips below the 200-day moving average. Ironically, this signal was followed by stabilization last August, although a full-fledged return of buyers had to wait three months.

News Background

Presto Research attributes the sharp drop in Bitcoin in recent days to hedge funds winding down positions focused on “basis spread” arbitrage. Basis on CME and Binance, in terms of annualized rates, are not yet showing signs of recovery.

SignalPlus draws attention to the weakening of Bitcoin’s implied volatility as prices fall, which acts as a symptom of speculators abandoning near-term growth expectations.

Gemini cryptocurrency exchange co-founder Cameron Winklevoss said that the US SEC has stopped investigating the platform and will not recommend any enforcement action.

Tether’s USDT stablecoin will soon support transactions on the Tron blockchain with no fees in TRX. According to Justin Sun, founder of the Tron ecosystem, the new option will become available in early March.

The FxPro Analyst Team