Market Picture

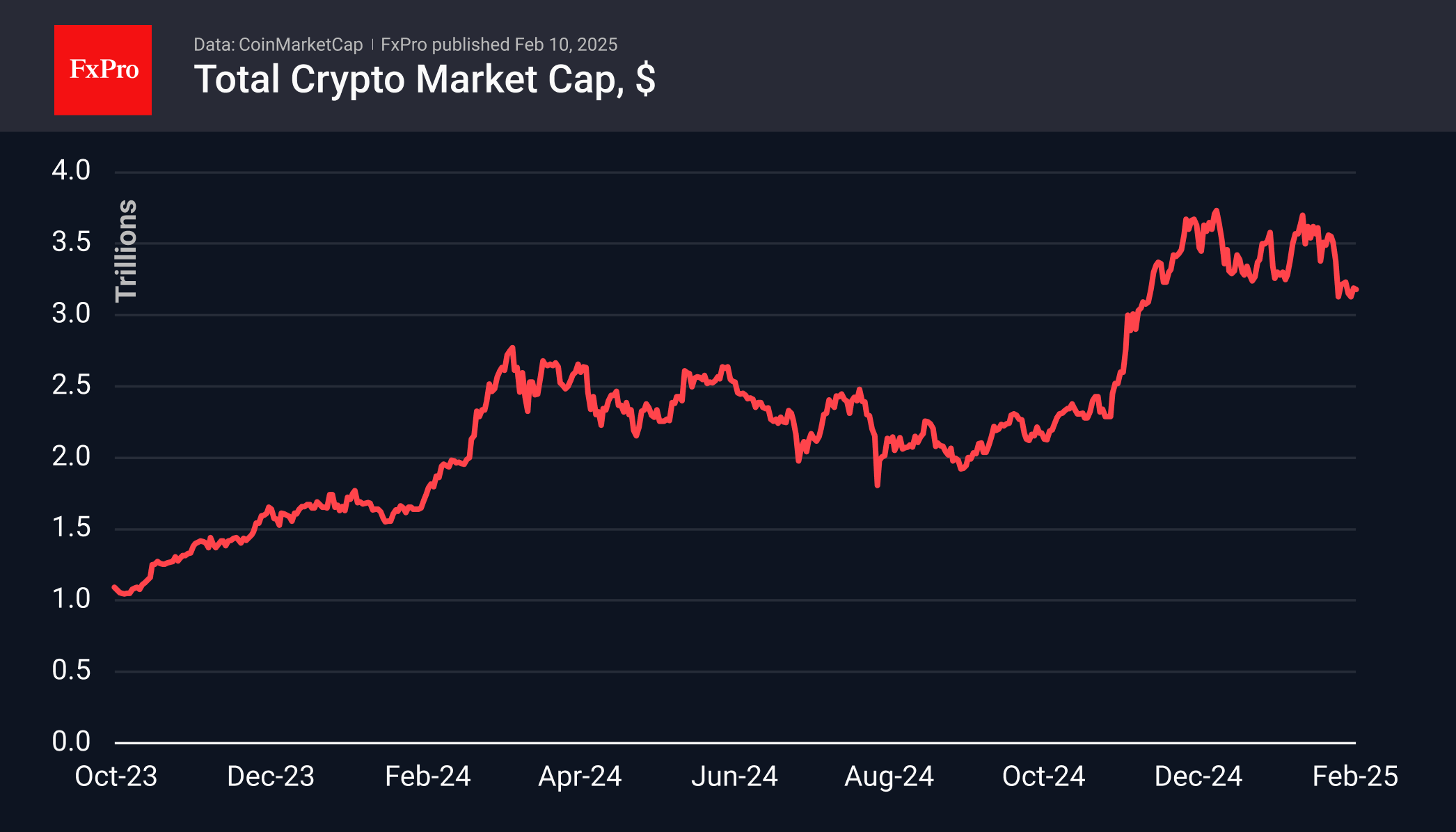

Crypto market capitalisation has been hovering in the $3.15-3.20 trillion range for the past few days. Although the initial reason for the collapse a week earlier was cited as fears of trade wars, cryptocurrencies, unlike the stock and currency markets, have not recovered from that blow. Which brings us to the worrying sentiment.

The Cryptocurrency Fear and Greed Index rolled back on Monday to 43 (fear), its lowest in four months. The market movement since the second half of December is reminiscent of what we saw in March-September last year. And this pattern is confirmed by the dynamics of the sentiment index, which is also smoothly creeping down from its peak in December.

Bitcoin is trading near 97500, once again running into resistance in the form of the 50-day moving average. The daily closing candles are forming a downtrend. It is obvious that the bears are controlling the market, but it is still impossible to find the capitulation point of the buyers.

News Background

According to SoSoValue, net inflows into US spot Bitcoin ETFs fell to $203.5m last week after inflows of $559.8m earlier, bringing the total amount of additions to $40.7bn. Net inflows into US spot Ethereum ETFs jumped to $420.1m last week to a total of $3.18bn.

Daily transaction volume on the bitcoin network fell 53% from its September peak, partly due to a drop in interest in the Runes protocol. Based on current on-chain data and Metcalfe’s Law, the fair value of BTC is in the $48,000-95,000 range, CryptoQuant estimates.

Japanese authorities have submitted a formal request to Apple and Google to block the apps of five unregistered cryptocurrency exchanges: Bybit, MEXC Global, LBank Exchange, KuCoin and Bitget. Apple has already complied with the request; Google has not responded to the regulator’s request.

In the run-up to the German parliamentary elections, the Alternative for Germany (AfD) party announced plans to achieve the complete deregulation of bitcoin and make the country a global leader in venture capital and startups.

The FxPro Analyst Team