Market Picture

Bitcoin gained 1.9% over the past seven days to $28.3K. Ethereum gained 4% to $1860. Other top ten altcoins showed mixed dynamics, ranging from a 1.4% decline (XRP) to a 6.2% gain (Dogecoin).

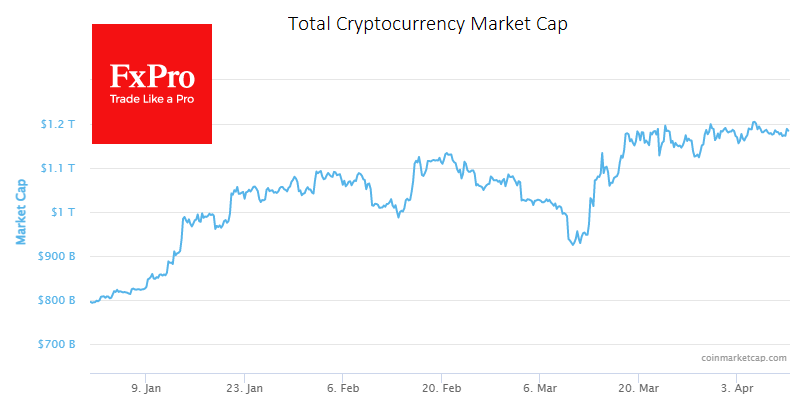

The total capitalisation of the crypto market, according to CoinMarketCap, rose 2% over the week to $1.185 trillion.

Bitcoin has been consolidating sideways, around $28K, for three weeks now. On Monday morning, the price briefly spiked above $28.5K in a thin market. On the daily timeframe, the range has narrowed since the beginning of the month, forming a bullish triangle. It is believed that the price will continue to move toward the breakout, with a rise above $29K opening the way to $35K, while a break below $27.5K may pave the way to $25.5K.

The latest recalculation of Bitcoin’s mining difficulty showed a new record, up 2.23% to 47.89T. The average hash rate for roughly two weeks since the last recalculation was also a record 342.16 EH/s. The 25% increase in the hash rate since the beginning of the year indicates growing confidence in the network.

New Background

SkyBridge Capital founder Anthony Scaramucci confirmed his bullish prediction that Bitcoin would reach $100K within three years. He has put BTC at $1 million by 2030, as has Ark Invest CEO Katie Wood.

Tether, the issuer of the first USDT stablecoin, announced that its SimpleSwap exchange service users can now trade pairs with Euro Tether (EURT) and Tether Gold (XAUT).

At the end of 2022, only 0.53% of investors worldwide paid taxes from digital asset transactions, Divly calculated. Finland (4.03%) and Australia (3.65%) had the highest percentage of these taxpayers.

According to CertiK’s report, blockchain projects lost more than $320 million to hacking and fraud in the first quarter of the year.

According to BitRiver, Russia became the world’s second-largest cryptocurrency mining country for the first time in Q1, with 1GW of mining capacity in operation. The US remains the leader with 3-4GW.

The FxPro Analyst Team