At one point yesterday, Bitcoin went into a correction, but it was short-lived. The bulls won, not only buying back the decline but also sending Bitcoin to new highs since May. Bitcoin is up 4.5% in the last 24 hours and is trading at $58,000. Over the previous seven days, BTC was up 6%. The Bitcoin dominance index has paused and is now at 45.8%. This is a positive sign as it indicates a stronger demand for alternative cryptocurrencies.

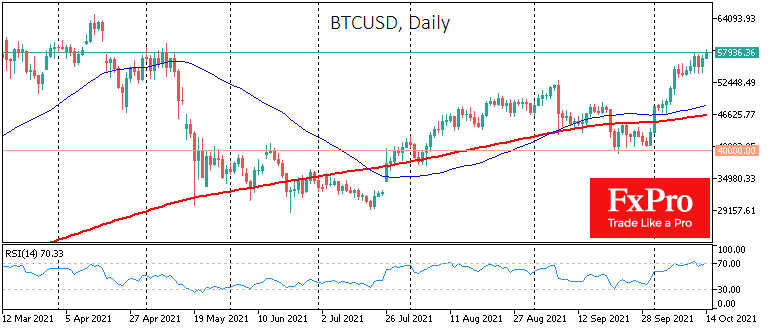

The Cryptocurrency Fear and Greed Index is at 70, which corresponds to the greed mode, indicating that there is still room for further growth. It is probably quite limited as, on the other hand, the RSI index for the BTCUSD pair on the daily chart shows dangerous proximity to an overbought level.

The alternative cryptocurrency market is also showing a very positive end to the working week. The major coins are rising following the market leader. Demand for altcoins often grows following the exhaustion of Bitcoin’s growth momentum, but in this case, it could be about broad investor interest in the entire cryptocurrency market. Altcoins are probably attracting more interest from the retail sector. For them, buying altcoins is a more psychologically comfortable investment due to the lower nominal price and the belief in the growth potential of new names.

On the bright side was the news that the US has become the global leader in Bitcoin’s hash rate network. The country currently holds 35.4% of the network’s computing capacity. After the Chinese authorities decide to eradicate anything related to cryptocurrencies, such news is positively taken, as America is a more stable and predictable participant in the crypto market. In addition, the distribution of computing power across many different territories is a great scenario to improve the security of the whole network. The second-largest player in the mining industry is Kazakhstan, but everyone understands that these are the same Chinese kicked out of their country.

The voices of those who talked about the temporary nature of inflation have noticeably diminished, and increasingly, we hear about it as a threat rather than a desirable goal for central bankers. Of course, it is difficult to think of BTC as a tool to hedge against inflation risks. Yet, it is one of the main reasons retail investors, who do not have many tools in their arsenal to protect their capital from losing purchasing power due to inflation, are buying cryptocurrencies.

Given Bitcoin’s relatively small market size, we might reasonably expect this to remain a meaningful booster to its quotations in the wake of news of rising prices. All conditions are met with money printing, debts are rising, and the stock valuations are inflated.

The FxPro Analyst Team