Market Picture

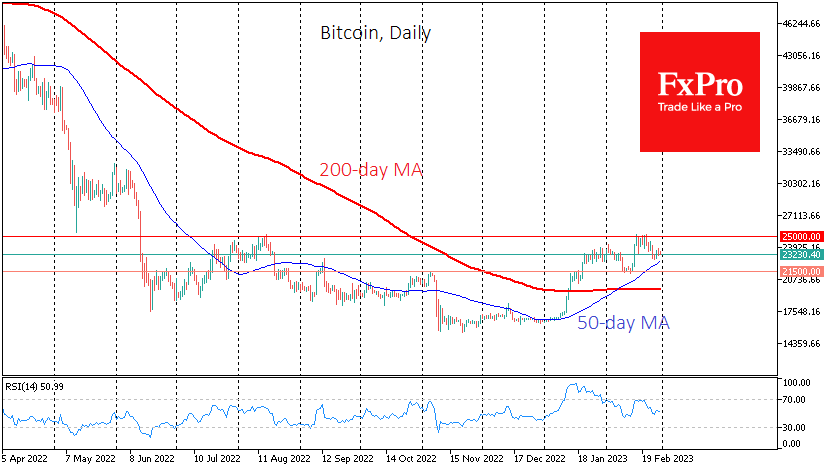

Over the past 24 hours, Bitcoin has fallen 0.25% to $23.4K. The total capitalisation of the crypto market has fallen 0.3% to $1.07 trillion. The slight decline came despite a rebound in global stock indices. The crypto market has seen minimal changes since the start of the day, indicating a wait-and-see attitude.

The short-term technical picture is bullish for Bitcoin, with the price above its 50-day average and near late January’s local highs. Ethereum’s uptrending 50-day twice acted as support in February. Resistance since last October remains at the 1700 level. ETHUSD is selling off from here.

According to CoinShares, investments in cryptocurrencies decreased by $2 mln last week, the third consecutive week of declines. Investments in bitcoin fell by $12 mln and Ethereum by $0.2 mln. Investments in funds that allow shorts on bitcoin increased by $10 mln.

Over the past few weeks, Santiment has seen a slowdown in bitcoin whales’ activity. There has also been a decrease in activity among mid-sized addresses controlling between 10 and 100 BTC.

News background

Michaël van de Poppe, Eight platform founder, remains bullish, saying the bear phase is over, and Bitcoin is about to break out.

According to IntoTheBlock, 39% of Ethereum’s total supply is concentrated on the balance sheets of a limited number of addresses. This starkly contrasts Bitcoin, where whales account for no more than 11% of the total.

The ongoing cryptocurrency crisis and tighter regulation have had no impact on interest in digital assets. According to Morning Consult, 20% of US adults (over 50 million people) own cryptocurrencies.

The FxPro Analyst Team