Market Picture

On Monday morning, the crypto market capitalisation stood at $2.07 trillion, up slightly from $2.05 trillion a week earlier. In the previous two weeks, the market failed to rally above the $2.15 trillion level, which has become a local resistance. The weakness in the crypto market undermines our confidence in a global recovery in risk appetite, even though last week was the strongest week for US equity indices in many months.

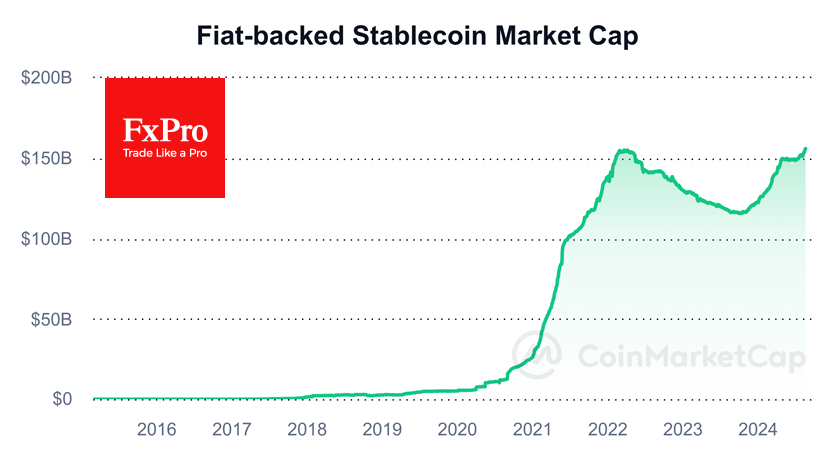

Interestingly, the sell-off from local resistance in the crypto market over the past two weeks has been accompanied by a surge in stablecoin capitalisation to new records after a prolonged sideways period from April to the end of July. Typically, the growth in stablecoin volume coincides with the bullish phase of the market. The crypto whales buy on dips, and it is clear from Bitcoin’s dominant dynamics that their focus remains on the first cryptocurrency, whose market share has risen to 56.5% – the highest since April 2021.

Litecoin’s dynamics illustrate what is happening in cryptos, except for the largest coins. Again, it’s mostly selling on growth. Litecoin fell sharply below its 50-day moving average in April and has been selling off on approaches to this line for the past four months. On Sunday, this downtrend touched again at around $67. An intensification of the negative trends could send the price to $56 (the area of the previous uptrend reversal) or even trigger a major liquidation with a slip below $50.

News background

According to SoSoValue, the spot bitcoin-ETFs saw modest total inflows of $32.6 million last week after two weeks of outflows. In contrast, the Ethereum-ETF saw net outflows of $14.2 million last week, with net outflows of $0.42 billion since the products were approved, compared to $17.37 billion for Bitcoin ETFs.

According to Bitcoin Magazine, nearly 75% of all Bitcoins in circulation have been inactive for more than six months, reflecting a hoarding trend. Factor LLC CEO Peter Brandt said Ethereum on the four-hour chart is ‘signalling’ a possible drop to $2,000 or even lower.

Bernstein gave shares of mining companies Riot Platforms, CleanSpark, IREN and Core Scientific an Outperform rating on the market. The IMF proposed an 85% increase in energy tariffs for bitcoin miners globally, which could significantly reduce carbon emissions.

Artificial intelligence-related crypto projects could fail due to the potential ‘collapse of the bubble’ in the sector, according to Blockcircle. AI in cryptocurrency is ‘largely fashionable,’ although there has been little real-world application of neural networks in the crypto sphere.

The absence of US Democratic presidential candidate Kamala Harris from the Crypto for Harris event has led the community to question her support for the crypto industry.

Chainalysis noted that attackers stole cryptos worth nearly $1.6 billion in the first half of the year, increasingly targeting centralised exchanges (CEX). The figure nearly doubled compared to the same period in 2023.

The FxPro Analyst Team