Market picture

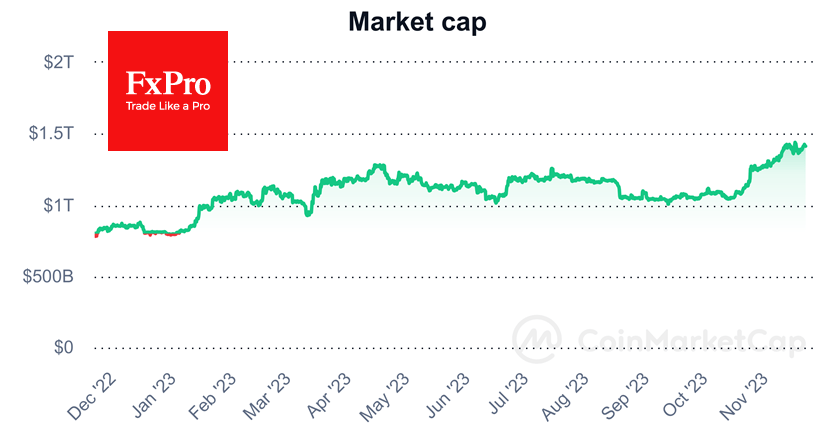

Crypto market cap retreated some 0.2% in 24 hours to $1.41 trillion. Bitcoin is up 0.7%, and BNB is up 5.3%, but most altcoins are down.

According to CoinShares, investment in crypto funds rose by $176 million last week; inflows are on track for an eighth consecutive week, having accelerated over the past four weeks. Bitcoin investment increased by $155 million, Ethereum by $3 million and Solana by $14 million.

Bitcoin continues to dominate, with inflows accounting for 3.4% of total assets under management over the past eight weeks. Total inflows into the digital asset since the beginning of the year are $1.32 billion, with inflows still well behind the 2021 and 2020 figures ($10.7 billion and $6.6 billion respectively), CoinShares noted.

70% of the available Bitcoin supply did not move from one wallet to another last year. That’s an all-time high.

News background

According to Bloomberg Intelligence, the spot bitcoin ETF market could attract as much as $100 billion from large mutual funds such as BlackRock, Fidelity and Invesco. Investment funds are already receiving hundreds of requests from clients looking to invest in digital assets.

Spanish bank Santander has enabled 210,000 wealthy clients in Switzerland to trade and store Bitcoin and Ethereum. The list of available instruments will be expanded in the coming months.

Bitcoin advocate Javier Milei has been elected president of Argentina. In the past, the libertarian MP has stated his intention to “burn” the central bank and abandon the peso in favour of the dollar to combat inflation. The Bitcoin price has since set a record high in Argentine peso.

According to Bloomberg, the US Department of Justice is seeking more than $4 billion from the Binance exchange as part of a settlement agreement in an investigation into alleged money laundering, bank fraud and sanctions violations.

The FxPro Analyst Team