Market Picture

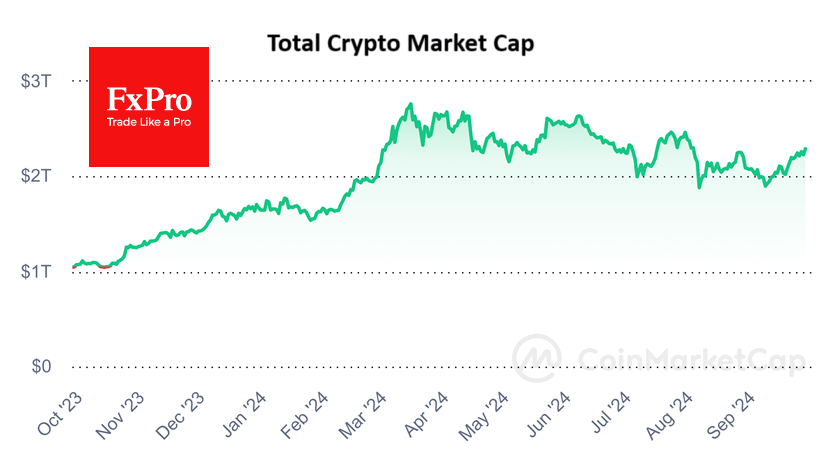

The cryptocurrency market went on to break previous peaks at the end of August, adding over 2.8% in 24 hours to reach 2.29 trillion, a high of almost two months. This rise confirmed the breakdown of the downtrend from the March peak after a higher local low in August. We foresee an easier climb up to previous pivot levels near 2.4 trillion, 4.8% above current prices.

Bitcoin, formerly the growth engine of the crypto market due to risk appetite in traditional finance, also made an important technical breakout. BTCUSD has consolidated above its 200-day moving average, broken local consolidation resistance, and is above the previous area of highs, having risen to $65.3K at the time of writing. The ability to break above $66K in the coming days would signal a move to all-time highs in the coming weeks.

News Background

In another recalculation, the first cryptocurrency’s mining difficulty decreased by 4.6% to 88.4T. The average hashrate for the period since the previous value change was 740.3 EH/s.

A decrease in the inverted US government bond curve after the Fed rate cut creates conditions for strengthening positions in risk assets, including bitcoin, Standard Chartered believes. Positive expectations are supported by an increase in open interest in call options maturing on 27 December with a strike price of $100,000.

CoinShares said in a report that Ethereum’s investment potential remains unclear. Ethereum’s growth is largely dependent on transactional demand for the asset, but so far, on-chain activity has focused mainly on speculation. The popularity of L2 solutions in recent years has ‘absorbed’ demand for the underlying network asset.

Payments giant PayPal has opened the ability for corporate customers in the US to buy, store and sell cryptocurrencies directly from their business accounts. Business account holders can also make external transfers of coins in the blockchain to third-party wallets.

On 26 September, crypto exchanges started trading Hamster Kombat token (HMSTR), a native cryptocurrency of the Telegram game of the same name, issued on the TON blockchain. The trading volume of HMSTR exceeded $150 million in the first half an hour. The cryptocurrency Wallet built into Telegram failed to cope with the load on the TON network and stopped loading. The Hamster Kombat team presented plans for the game’s development in the coming months. The developers promised new games, NFT and token burning.

The FxPro Analyst Team