Market Overview

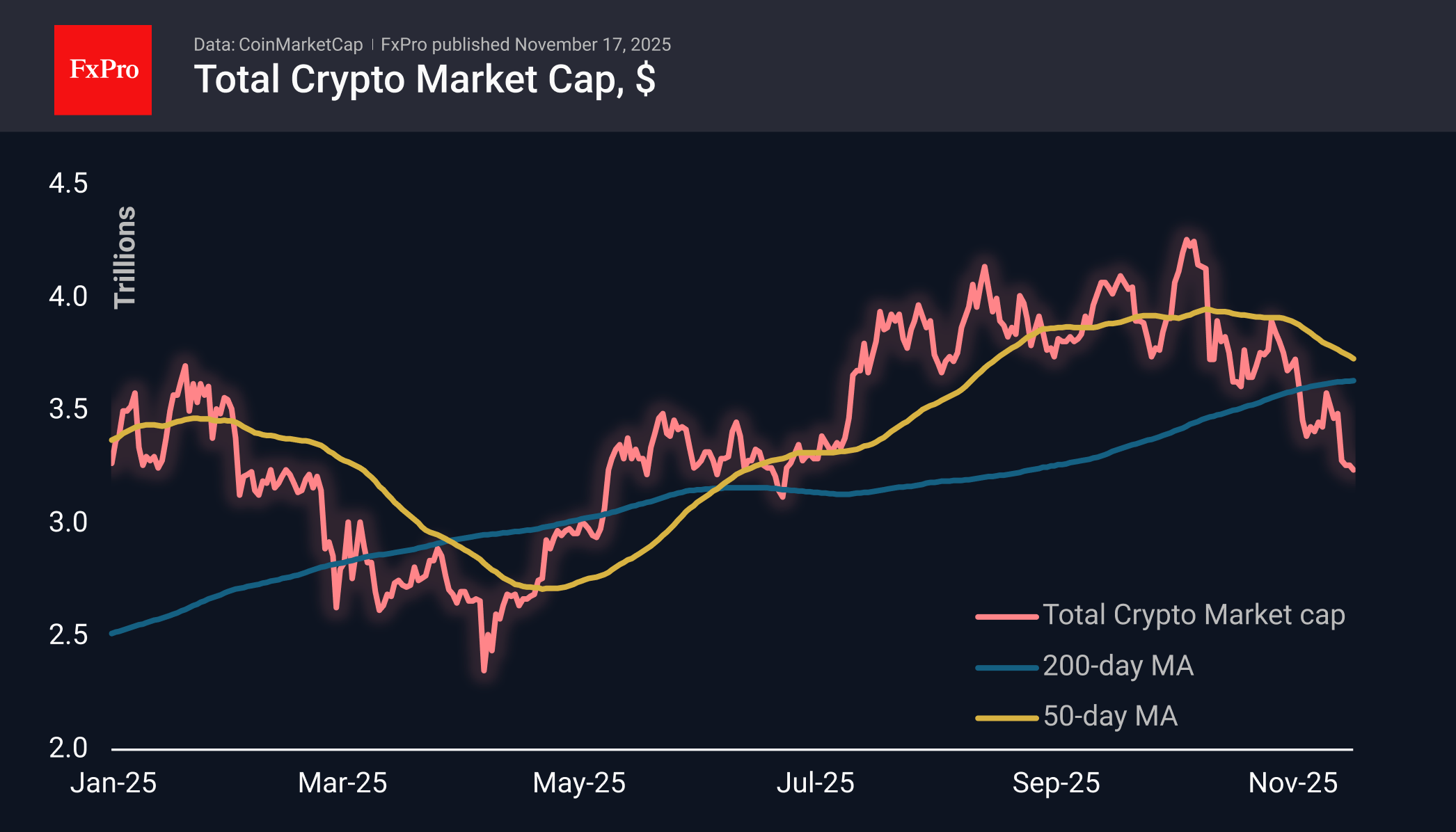

The crypto market cap has lost 9.5% over the past seven days. The decline took place on weekdays last week, with the level stabilising around $3.25 trillion over the weekend. Among altcoins, the standout is the unsinkable Zcash at $700, nearing its highs, and weak Solana and Ethereum, which have lost 45% and 40% from their August and September highs, respectively.

The crypto sentiment index recorded values of 10 on Saturday and Sunday, marking a return to the lows of late February this year. Although this was a good point to buy on the rebound in the following days, the downward trend continued for almost a month and a half. Market dynamics since the beginning of October have been reminiscent of those seen at the end of January. This is good news for short-term buyers but may cause medium-term buyers to stay on the sidelines for a while.

Bitcoin slipped below $93K during illiquid trading early in the day, but found impressive buyer interest there, rising to $95.6K. Whether this is a short-term rebound or the beginning of a recovery can only be determined after it consolidates above $100,000. There is a high chance that the strategy of selling on rebounds will remain prevalent.

News Background

Outflows from spot Bitcoin ETFs in the US continue for the third week in a row. According to SoSoValue, net outflows from spot BTC ETFs totalled $1.11 billion last week, slightly lower than the previous week’s outflows, resulting in a total inflow of $58.85 billion into these products since January 2024.

Net outflows from spot Ethereum ETFs in the US continue for the second week in a row, amounting to $728.6 million. The cumulative net inflow since the launch of ETFs in July 2024 has fallen to $13.13 billion.

Inflows into the recently launched Solana spot ETFs in the US have continued for the third consecutive week, totalling $382.1 million. However, during this time, the price has fallen by a third, reinforcing the idea that entering traditional financial markets does not necessarily promise price growth.

Long-term Ethereum holders have increased their sales to 45,000 ETH per day, the highest level since February 2021, according to Glassnode. Long-term Bitcoin holders are also actively selling their holdings. According to CryptoQuant, they have dumped 815,000 BTC on the market over the past month.

Miner Bitfarms has announced a gradual phase-out of Bitcoin mining and a transition to developing infrastructure for artificial intelligence. The company reported a net loss of $46 million in its third-quarter report.

The FxPro Analyst Team