Market picture

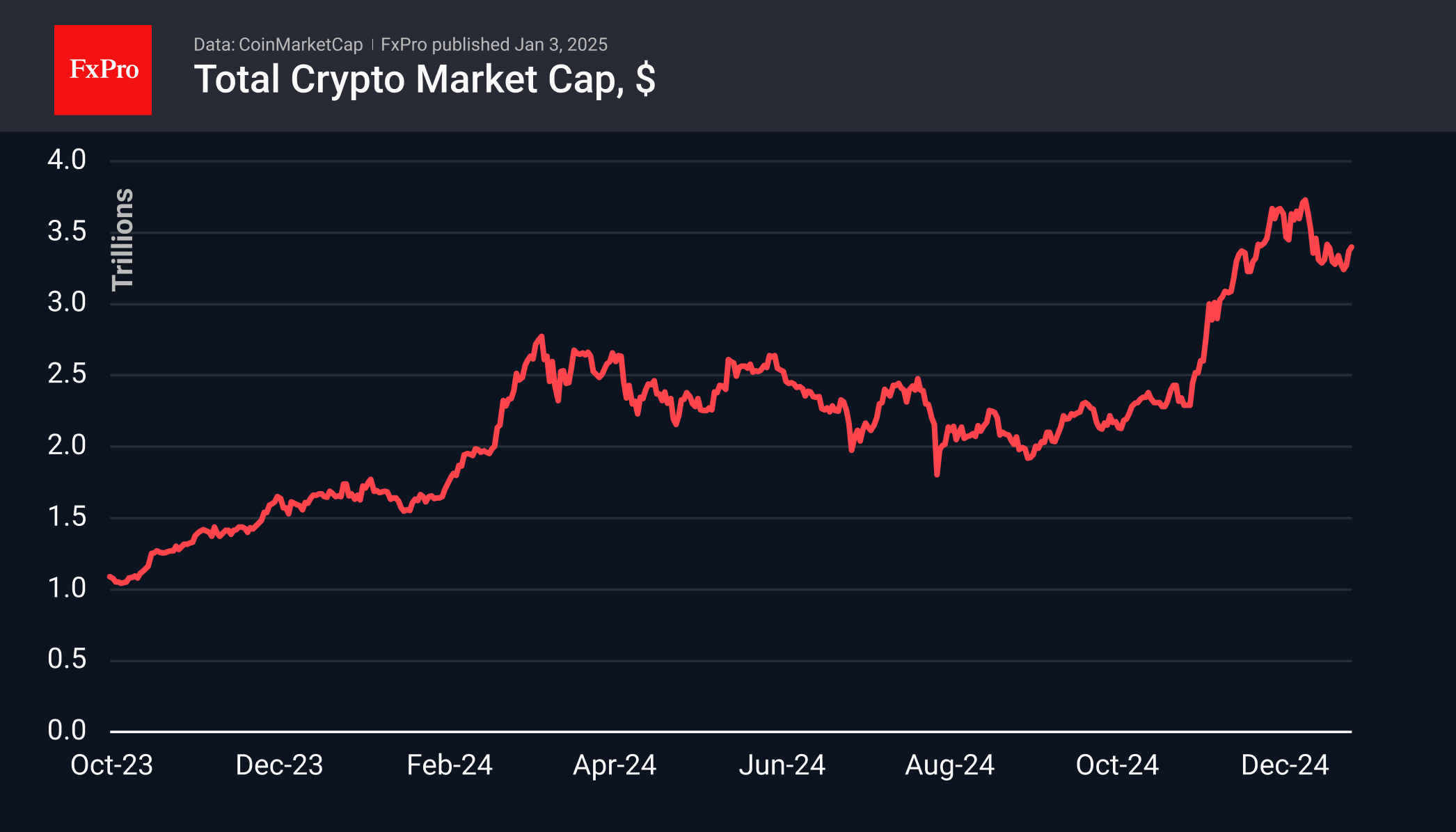

The crypto market is trying to start 2025 with growth, adding 4% since the beginning of the year. Like in late December, the market is stalling on reaching a capitalisation of $3.41 trillion. This time, the positive mood of cryptocurrency enthusiasts was undermined by a sharp downward reversal in the US and Chinese stock markets.

We pay attention to the reduced trading volumes, which indicate a wait-and-see attitude among market participants and a search for new ideas. At the same time, the support of around $3.20 trillion makes the latest pullback a correction, not a reversal.

Bitcoin fell 3.5% to $93,600 in December. Growth for the full year of 2024 was 120% after 158% a year earlier. The first cryptocurrency has strengthened for seven months in the past year, becoming one of the year’s best-performing assets.

In terms of seasonality, January is considered a relatively successful month for BTC. Over the past 14 years, bitcoin has ended the month with growth on seven occasions. The average rise was 22.5%, while the average decline was 14.6%.

Technically, bitcoin has bounced off the 61.8% level from the November rally and is attempting to return above the 50-day moving average. A solid break above $97,000 will allow us to expect new highs above $110,000 soon. However, we should be prepared for a strengthening of selling, as we are currently seeing in equities.

News Background

IntoTheBlock notes that through 2024, the number of long-term Ethereum holders has been rising, while Bitcoin’s metric has been steadily declining. The percentage holding ETH for more than a year increased from 59% in January to 75% in December. For BTC, the metric dropped from around 70% to 62%.

Another recalculation increased the first cryptocurrency’s mining difficulty by 1.08%, reaching a record of 109.78 T. The average hash rate for the period since the previous change was 777 EH/s.

MicroStrategy purchased an additional 2,138 BTC for ~$209 million over the past week at an average price of around $97.837 per coin. The company holds 446,400 BTC purchased for a combined $27.9bn at an average price of $62,428 per coin.

CoinGecko calculated the profitability of crypto market sectors in 2024. The most profitable narrative of the crypto industry was AI. Second and third place went to meme coins and RWAs.

CryptoQuant notes that Coinbase’s premium has reached a 12-month low. This signals insufficient institutional demand and caution among US investors.

The FxPro Analyst Team