Market Overview

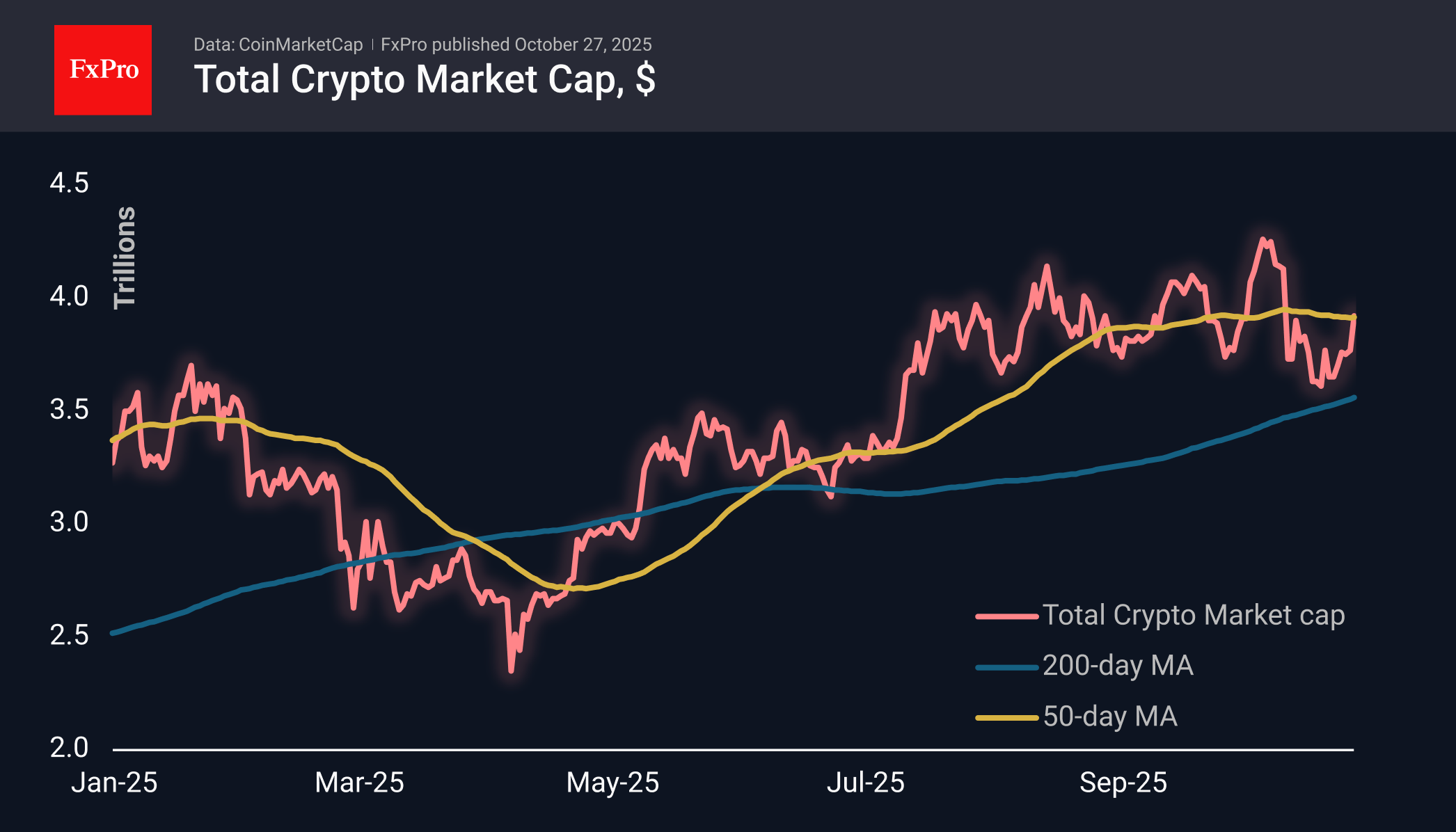

The crypto market capitalisation has gained 4% in 24 hours, confidently adding to positive signals from trade negotiations between China and the US. News from the two largest economies remains cyclical, with positive signals following meetings and high-level direct negotiations the day before. Total capitalisation reached $3.92 trillion, recovering to the 50-day moving average (MA), staying above the 200-day MA of $3.51 trillion at the start of last week.

The sentiment index recovered to 51, quickly returning to neutral territory. Unlike the spring episode, this time the recovery came almost immediately after touching levels of extreme fear.

Bitcoin rose above $116K on Monday morning, pushing off the 200-day MA as support last week and exceeding the 50-day moving average at the start of the new week. The $117K–120K area is a strong resistance zone. The rallies in August and early October proved to be unsustainable. Perhaps, by bouncing off the 200-day MA, BTC, as it did in April, will gain enough momentum to renew its highs.

News Background

According to SoSoValue, net inflows into spot BTC ETFs totalled $446.4 million last week, marking the lowest level in the last seven weeks. This brings the total inflows since the approval of Bitcoin ETFs in January 2024 to $61.54 billion.

Net outflows from spot ETH ETFs fell to $243.9 million for the week, reducing the cumulative net inflow since the launch of ETFs in July 2024 to $14.35 billion.

According to OnChainSchool, the volume of bitcoins that have been inactive for more than seven years and have been moved since the beginning of the year has reached a historic high. Long-term BTC holders continue to take profits by actively selling coins.

Owners of 100-1,000 BTC, so-called Dolphins, control the largest share of bitcoins — about 26%, making their activity a key market factor in the late stage of the bullish phase, CryptoQuant notes. CryptoQuant considers ETFs, corporations and other large holders to be dolphins.

BitMine CEO Tom Lee suggested that Bitcoin could fall by 50% to $55,000 in the event of a significant correction in the US S&P 500 stock index.

Altcoins could have had $800 billion more in capitalisation this year were it not for BTC ETFs. Growing interest in Bitcoin and BTC ETFs could cause an even greater decline in the alternative coin market, according to 10x Research.

The FxPro Analyst Team