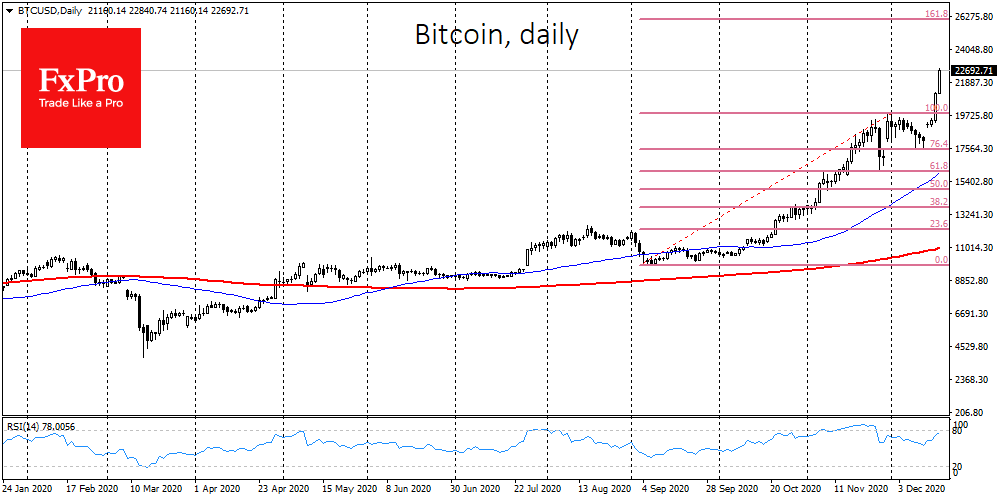

Exactly 3 years have passed since Bitcoin set its previous all-time high just under $20K. Most market participants who caught the rally back then now have a pleasant but unsettling deja vu, because that’s when Bitcoin’s decline began, which subsequently led to the “crypto winter.” There are also some differences this time around: in 2017 the emergence of institutional investors in the market led to a sharp sell-off, as they had the opportunity to open short positions. This time it was big capital that created the conditions for a surge in the market. Moreover, the rally of Bitcoin itself took off from a much higher point, doubling in price since September, whereas three years earlier it had risen 5.5 times during the same time frame.

In just one 24-hour period, Bitcoin jumped $3,600 and is already trading above $23K. Along with the price, trading volume has more than doubled, further bolstering confidence in the rally at this stage. The Bitcoin dominance index rose by almost 2% to 65.51% over the day. The volume of Bitcoin short position liquidations in the futures market on December 16th was over $500 million. Alternative cryptocurrencies followed Bitcoin’s lead. Virtually the entire market is growing right now but the most notable growth is within the top 10. For example, Ethereum (ETH) is adding 11% and trading around $650. It is very likely that this is far from the limit of growth even within the current bullish wave. In other words, we are only witnessing the beginning of the rally across the sector.

So what are the main differences with 2017, and why hasn’t the current growth momentum exhausted its potential? The driving force behind the 2017 rally was retail FOMO. In 2020, however, retail investors tended to stay on the sidelines. When the rally brought Bitcoin close to $20K, retail investors began buying altcoins as they were not yet close to their all-time highs. However, institutional demand for liquid instruments concentrated around a few instruments.

It is very profitable for institutional investors to create a sense of euphoria in the market but so far most are cautious about what is happening. Nevertheless, there will be no sign of common sense in the case that BTC continues to grow at such a pace, for example, during the next week. That will be the most dangerous moment of the current rally because the overbought technical indicators will be stronger than FOMO at some point.

The FxPro Analyst Team