Market picture

Crypto market capitalisation grew by 2.1% to $1.65 trillion, driven by Bitcoin (+2.5%), Ethereum (+2%) and the outperformance of Solana (+6.4%), Cardano (+6%) and the smaller Chainlink (+14%).

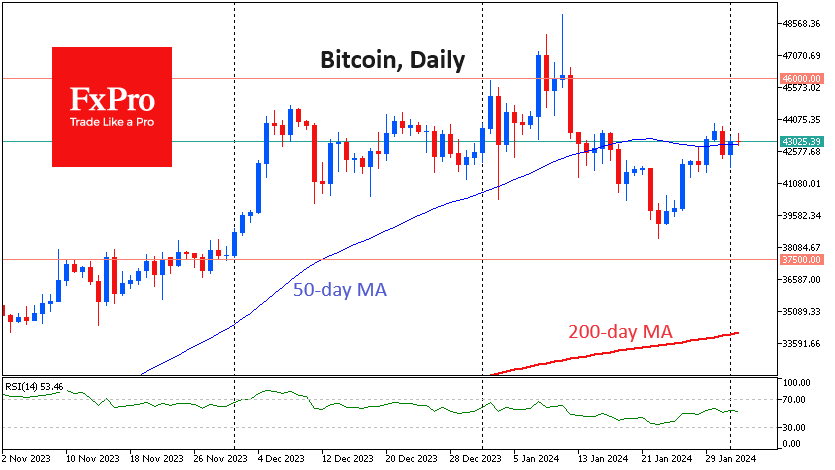

US statistics remain a crucial driver of growth. Thursday’s data release sparked a rally in Bitcoin, which rose almost 3%, taking the price back above $43,000 and above its 50-day moving average. Solana is also just above it, while Ethereum is just below this curve.

The 50-day moving average is an indicator of the medium-term trend. The fact that the major coins seem to be stuck at it suggests that the market has not decided on the trend. This is also indicated by the willingness to react to news, which is important for the stock market. These are all consequences of the lack of an internal driver, which could be breakthrough technologies, halving or regulation.

New background

According to crypto journalist Colin Wu, net inflows into spot bitcoin ETFs have approached $1.5 billion. Withdrawals from Grayscale’s GBTC continue to slow. Assets under management rose to $27.8 billion, approaching their peak on 12 January.

Tether, the issuer of the largest USDT stablecoin, posted a record $2.9 billion net profit for the fourth quarter, with $1 billion coming from interest on US Treasuries and the rest from a positive revaluation of bitcoin and gold reserves.

The bankrupt FTX exchange plans to repay its liabilities to customers in total, but a relaunch of the platform is not being considered. Lending platform Celsius, which is going through bankruptcy proceedings, will pay $3 billion to creditors under an approved reorganisation plan.

According to The Block, transaction activity on the Solana network reached its highest level in over a year. Blockchain users completed transactions totalling more than $951 billion in January.

According to IntoTheBlock, the number of new addresses on the Dogecoin network increased by 1,100% over the week but has yet to impact the coin’s price.

The FxPro Analyst Team