Market picture

The crypto market capitalisation rose 1.2% in 24 hours to $1,043. The market’s fall to almost $1 trillion at the beginning of the week satisfied the sellers. The question is whether the recent dip will be the starting point for the next rally. Keep an eye on the activity near the recent highs; for now, the market is not allowed to go higher.

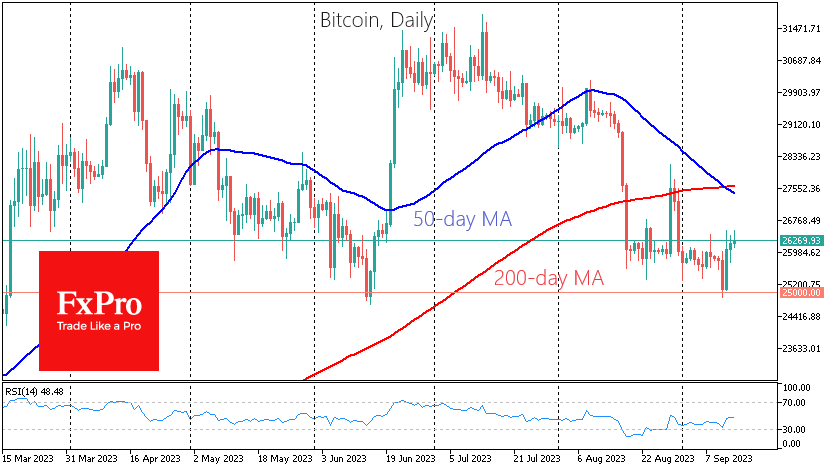

For bitcoin, the death cross has not yet led to an intensified sell-off. The accumulated oversold condition that has exhausted the sellers is having an impact. Despite the potential for a rebound, BTCUSD remains within the bearish momentum that has been in place since July, with lower and lower highs and lows.

Ethereum, which formed a death cross at the beginning of September, remains in a downtrend, although its intensity is decreasing.

News background

The SEC continues to review the court’s decision in the Grayscale case, as well as numerous applications for spot bitcoin ETFs, the regulator’s head, Gary Gensler, said during a congressional hearing.

Ripple CEO Brad Garlinghouse called the US one of the “worst places” to launch crypto projects, blaming the SEC for the situation.

The bankrupt FTX has changed its cryptocurrency offering and will no longer give the markets advance notice of its upcoming sale. The court allowed FTX’s creditors to sell $3.4 billion worth of cryptocurrency to pay off their debts earlier. This amount includes $560 million in Bitcoin (BTC), $192 million in Ethereum (ETH) and $1.16 billion in SOL.

The Telegram messenger has integrated a cryptocurrency wallet based on The Open Network (TON) into the app for its more than 800 million users.

The FxPro Analyst Team