Market Picture

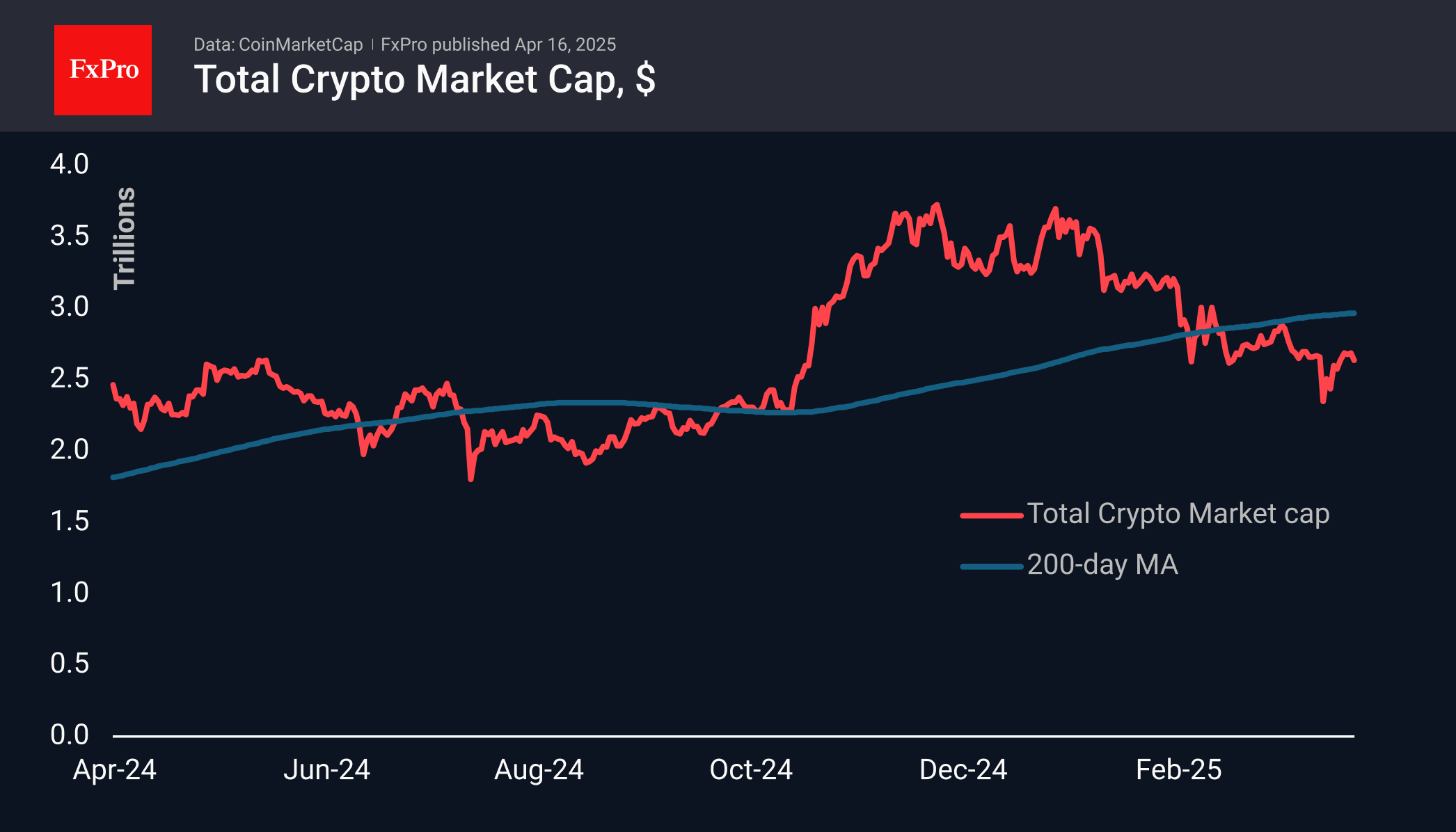

The crypto market capitalisation fell by 2.6% in the last 24 hours, dropping to $2.63 trillion. The selling pressure intensified amid announcements that the US may raise duties on Chinese goods to 245%. This news hit fertile ground as the market had already reached the levels of the last consolidation, and after the recent rebound, a correction was looming.

Bitcoin is losing with the market, facing resistance in the form of a cluster of 50- and 200-day moving averages. The importance of these levels suggests some pause in the move, but the chances of a rebound remain high. The low point in early April was more than 30% below historical peaks, making current levels attractive to long-term buyers.

News Background

MN Trading founder Michael van de Poppe notes the growth in money supply as measured by the M2 aggregate, which he believes could lead to Bitcoin updating its record high (ATH) this quarter. Macro analyst TomasOnMarkets adds that the amount of liquidity in the financial system has increased to $6.3 trillion, creating a favourable backdrop for BTC growth.

Bitcoin reserves of publicly traded companies increased 16% in Q1 to 688,000 BTC (~$56.7bn), Bitwise calculates. Over the three months, companies built up reserves by 95,431 BTC, and at least 12 public companies invested in bitcoin for the first time.

Canada is launching the world’s first spot Solana ETFs. The funds will offer a Solana staking feature, potentially providing higher returns than similar Ethereum-based products and lowering the ETF’s cost of ownership, TD Bank said.

The FxPro Analyst Team