Market Overview

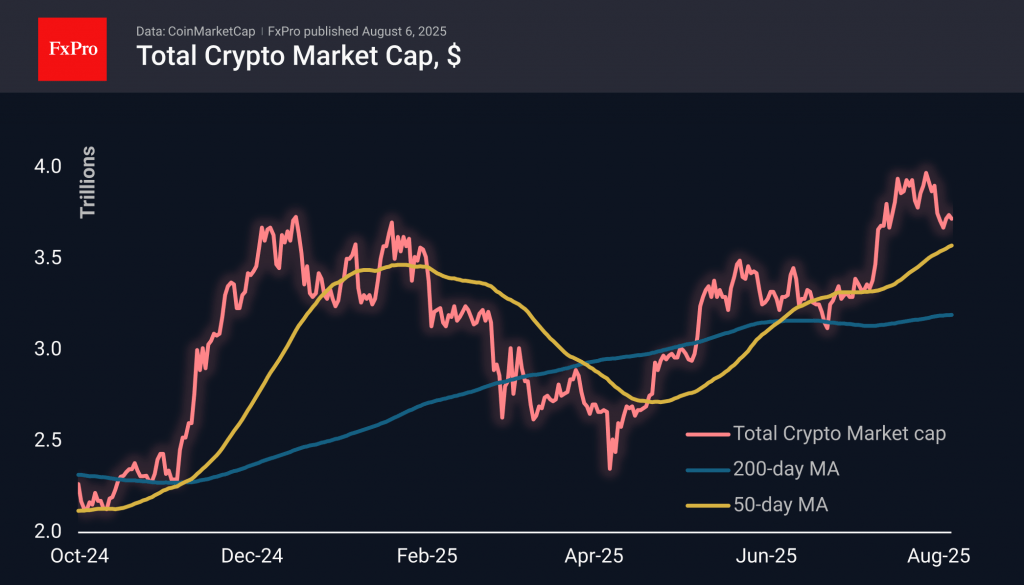

The cryptocurrency market began August with a relatively narrow range of $3.6-3.8 trillion, ending Wednesday at $3.72 trillion. The support received in the area of previous peaks set in December and January suggests that this is a temporary pause to lock in profits and gain liquidity before a new surge. At the same time, however, such sluggishness is turning away the most active traders, who are used to seeing multiple rallies. Now they have moved on to very small projects.

On Tuesday, Bitcoin was again approaching its 50-day moving average. Such frequent testing of the medium-term trend signal line indicates accumulated fatigue in the first cryptocurrency. For comparison, the crypto market’s total capitalisation is still moving significantly above its 50-day average, which is currently around $3.57 trillion.

News Background

Institutional investors are actively buying up Ethereum, while retail traders remain on the sidelines. SharpLink bought 83,561 ETH ($264.5 million) last week at an average price of $3,634. The company’s reserves amount to almost 522,000 ETH (~$1.9 billion). However, Bitmine Immersion Tech remains the leader, with 833 coins worth over $3 billion. A total of 64 corporations now own 2.96 million ETH ($10.81 billion) or 2.45% of the total Ethereum supply.

Large companies continue to buy Bitcoin, adding 26,700 BTC to their reserves in July. Strategy bought 21,021 BTC for $2.46 billion last week. According to BitcoinTreasuries, public and private companies now hold 1.35 million BTC ($155 billion) on their balance sheets — more than 6% of the total digital gold supply.

US regulators have proposed new rules for the crypto industry. The CFTC has launched an initiative to legalise spot trading of cryptocurrencies on registered exchanges, and the SEC has updated its guidance on stablecoin accounting rules.

USDe from Ethena Labs has become the third-largest stablecoin. Since mid-July, its capitalisation has grown by 75% to $9.5 billion. Demand for the asset may have been spurred by high yields ranging from 10% to 19% per annum. The total capitalisation of all stablecoins has been growing for the seventh month in a row and is approaching $275 billion.

The FxPro Analyst Team