Market picture

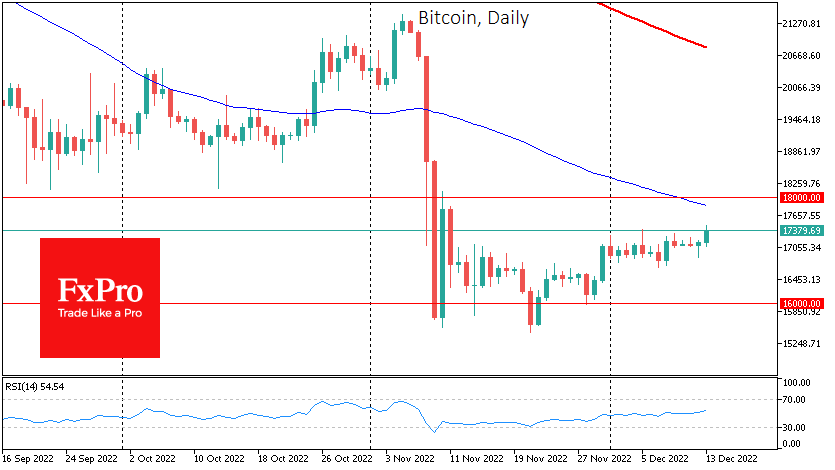

Bitcoin recouped all its early-day losses in the US session on Monday amid rising stock indices. BTC climbed above the $17,000 level, extending a period of almost no change in price that has become particularly pronounced this month. This is despite rising stock market volatility.

By Tuesday, the cryptocurrency Fear and Greed Index remained unchanged at 27 points (fear).

According to CoinShares, crypto investments saw an inflow of $9M after two weeks of outflows. Bitcoin investments increased by $17M, while Ethereum decreased by $2M. Investments in funds that allow shorts on bitcoin fell by $4M. Weekly trading volumes hit a new two-year low of $677. Sentiment towards bitcoin has steadily improved since mid-November, with total inflows of $108M since then, CoinShares noted.

That said, it would be incorrect to say that nothing is happening in cryptocurrencies. There is plenty of negative news.

News background

The Wall Street Journal and Reuters criticised Binance on Monday – a rare synchronisation by the iconic financial media. The exchange had to defend itself and publish evidence that Reuters had misinterpreted its words.

Nevertheless, it is reported that more than $1.4bn has been withdrawn in 24 hours, and as of Tuesday morning, Binance has paused the USDC withdrawal. The reason cited is that New York banks were closed. Traditional banks in such circumstances could not withstand the onslaught of deposits run as they did not have as much liquidity. As it turned out, FTX did not have the liquidity either. Will Binance withstand this test? The severe churn will likely continue for a few days, after which it will be possible to tell whether Binance is as honest and transparent as it claims.

A report by audit firm Mazars on Binance’s bitcoin holdings has yet to convince that users’ assets on the platform are safe, experts interviewed by The Wall Street Journal said.

Nobel laureate Ben Bernanke criticised cryptocurrencies. The Nobel Prize-winning economist is convinced that cryptocurrencies are doomed to fail regardless of whether they are regulated.

The FxPro Analyst Team