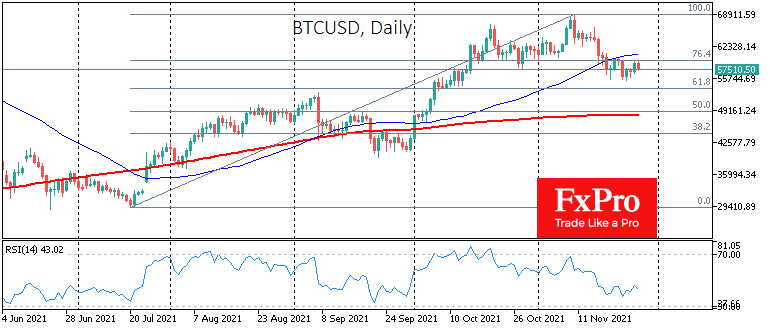

The cryptocurrency market opens Friday on a positive note, while traditional markets are experiencing a classic risk-off. Bitcoin has lost 2% since the start of the day, but this pullback has so far only brought it back to Tuesday’s levels at $57.5. Since the beginning of the week, bulls have been buying BTC and ETH on dips, forming higher lows sequence.

However, this support looks like thin ice that may not withstand a heavy, more than 2% drop in key Asian indices from the start of the day on Friday and a decline of around 1% in US index futures.

With increased equity market volatility, crypto investors should be on guard. Because of the institutional love affair, Bitcoin is substantially vulnerable to moments of exit from risky assets when it sells off everything, regardless of the outlook. And its severe sell-off risks dragging the entire cryptocurrency down with it.

From a different perspective, retail investors have developed a reflex to buy crypto on coronavirus fears, with WHO discussing new virus variants and restrictions on air travel. This means that real crypto-enthusiasts and long-term investors in cryptos may consider buying it out of the severe downturn on the exit of traditional financial institutions.

The FxPro Analyst Team