Market picture

The pressure on financial markets has spread to cryptocurrencies – the flip side of the long-desired easing of institutional access to the crypto market. The launch of the Ethereum ETF coincided with the most powerful drop in the Nasdaq index in months. The cryptocurrency market lost 3.5% in the last 24 hours, pulling back at one point to $2.3 trillion, its lowest in 10 days.

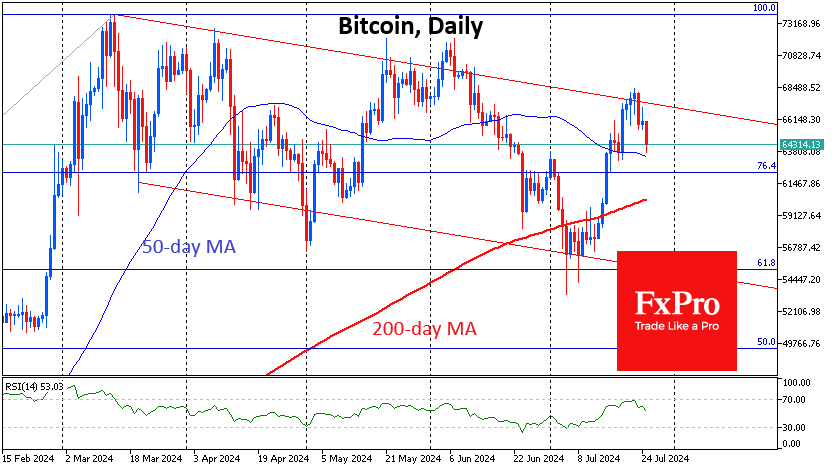

Bitcoin is down to $64.0K, once again approaching the 50-day MA where it consolidated for most of last week. There are small hopes that the first cryptocurrency will gain support near this level. However, this week could be just the beginning of a decline from the upper boundary of the BTCUSD downtrend channel. In this case, an important test of strength will be in the $60K area, where the 200-day MA and the significant milestone are held.

Ethereum is already testing the 200-day MA, having lost over 9% in less than 24 hours to 3150. In early July, the major altcoin steadily gained support after touching this curve. However, these purchases could be largely credited to the expectations of the ETF launch. Now, this speculative factor is out of play, multiplying sell-the-fact activity on top of global markets risk-off.

News background

Spot Ethereum-ETF trading volume on the first day after listing totalled $1.08bn – that’s 23% of the bitcoin-ETF’s first day, with net inflows estimated by SoSoValue at $106.7m.

Creditors of bankrupt exchange Mt.Gox have started receiving Bitcoin and Bitcoin Cash transfers to accounts in Kraken. According to Arkham Intelligence, the exchange’s address no longer has assets.

The Hash Ribbons indicator gives a signal to buy Bitcoin. On 23 July, the indicator came out of “capitulation” for the first time in almost two months. Whenever this happens, an “explosive price rise” follows, noted analyst Mikybull.

Bitcoin investors can become EU citizens by investing €500,000 in the cryptocurrency through Portugal’s “golden visa” programme.

Italian car manufacturer Ferrari will start accepting cryptocurrencies as a payment method in Europe at the end of July. The decision follows the initiative’s successful launch in the US territory in the autumn of 2023.

According to a Europol report, bitcoin remains the most popular crypto asset among criminals despite the efforts of international law enforcement agencies and governments. The hype surrounding the Ordinals project and the launch of the bitcoin-ETF could trigger a new wave of cyber threats.

The FxPro Analyst Team