Market Overview

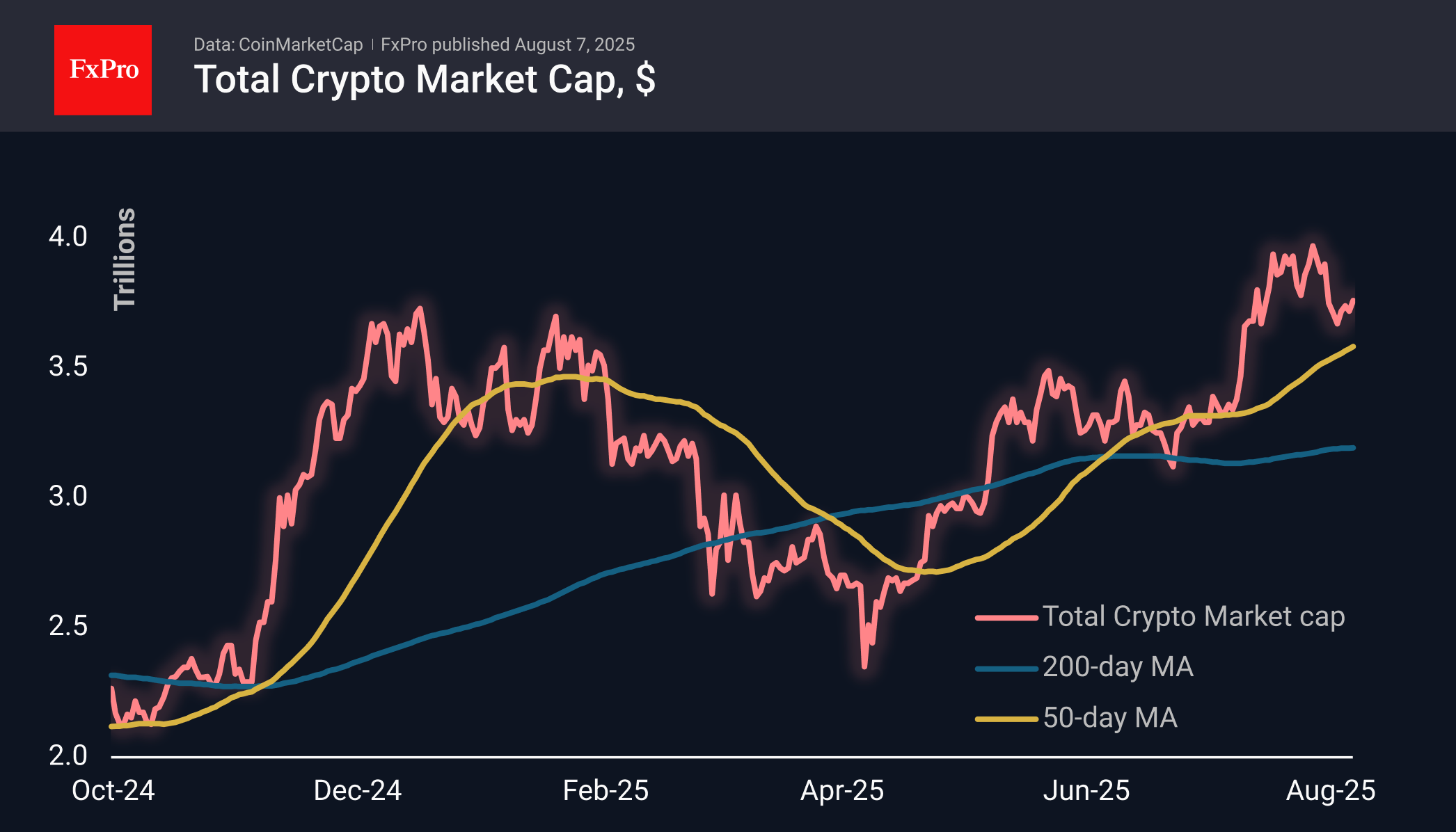

The crypto market increased its capitalisation by almost 1% over the past day to $3.76 trillion. This smooth recovery is consistent with the growing appetite in the stock markets, where the Nasdaq100 is approaching peak values, trading just over 1% below its historical highs. The growth drivers remain the leading altcoins ETH (+2.4%), XRP (+1.7%), Solana (+3.7%) and Dogecoin (+2.7%) against a modest +0.7% for BTC.

Bitcoin is approaching $115K on Thursday morning, reinforcing confidence in a rebound from the 50-day moving average in the first days of the month. However, the situation is clouded by uncertainty due to trading within a narrow range. Signals for a continuation of the movement will be a breakout of support at $112K (recent local lows and 50-day average) or a breakout of resistance at $120K (July peaks and an important round level).

News Background

According to Glassnode, Bitcoin has moved from a stage of euphoria to a stage of cooling off, with pressure from sellers intensifying. Demand from large companies and investment funds is weakening, capital inflows into spot Bitcoin ETFs have fallen by almost a quarter, network activity is declining, and transfer volumes and commission fees are shrinking. In such conditions, any recovery will be short-lived, as there are no fundamental catalysts for a rally.

Options point to expectations of a decline in Bitcoin and Ethereum by the end of August. Analyst Sean Dawson notes that investors are hedging en masse in case of a sharp pullback in BTC below $100,000.

Well-known trader Ton Weiss suggested that the concentration of Bitcoin in the hands of large American companies creates risks of centralisation, and the US authorities may try to confiscate it in the event of an economic crisis, as they once did with gold. In his opinion, this could happen in 2032–2033.

As part of Project Crypto, the US SEC has clarified that liquid staking is not usually subject to securities laws.

US President Donald Trump is going to sign an executive order imposing penalties on banks that refuse to serve crypto companies, The Wall Street Journal reported, citing sources in the White House.

The FxPro Analyst Team