Market picture

The cryptocurrency market pulled back 3% to a capitalisation of $2.4 trillion, erasing gains for a while due to the Bitcoin conference. For the past week and a half, the market has been predominantly moving in the $2.4-2.5 trillion range. The hesitancy of traders this week can easily be blamed on expectations of important rate decisions from key central banks and Friday’s US jobs report later in the week.

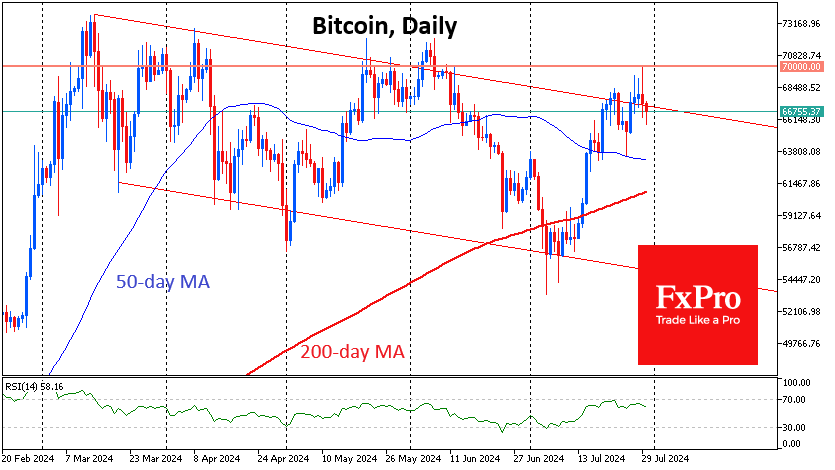

Bitcoin spent a few seconds above $70K on Monday before undergoing a powerful sell-off that took its price below $66K at the peak of the decline in Asian trading on Tuesday. The market was pressured by reports that the US government had put 30K Bitcoins ($2.1bn) into circulation.

One can only wonder whether this is part of a trend following the Mt Gox and German government sales, a game of anticipation before Trump came to power and banned these sales, or whether it’s all about the “high price.” Only further transactions will help us to find an answer. There are believed to be over 203k bitcoins on the balance sheet, a concentrated sale of which could sell off the market.

Technically, yesterday’s breakout of resistance by Bitcoin may still be false, and the latest rise slightly changes the angle of the downtrend but does not break it.

News background

According to CoinShares, crypto fund investments rose by $245 million last week after inflows of $1.353 billion a week earlier; the figure is up for the fourth week in a row. Bitcoin investments were up $519 million; Ethereum was down $285 million, and Solana was down $3 million.

29 July marked 100 days since BTC’s fourth halving. ETC Group noted that bitcoin has historically started to move towards updating all-time highs (ATH) after the end of this period. Bitcoin’s post-halving consolidation is “pretty much over,” according to co-founder Okse.

BrainChip Holdings believes Bitcoin miners have probably started a new phase of accumulating coins to capitalise on the potential price rise. Such behaviour by market participants indicates confidence in BTC’s long-term outlook.

HashKey Global believes the main catalyst for Bitcoin’s growth is US presidential candidate Donald Trump’s decision to become a major supporter of the cryptocurrency. He recently stated that Bitcoin has the potential to surpass gold in terms of market value in the future.

Co-founder of cryptocurrency exchange Gemini Cameron Winklevoss called on Democratic presidential candidate Kamala Harris to fire SEC head Gary Gensler as soon as possible to prove her support for the crypto industry.

The FxPro Analyst Team